Globalization is increasingly pressuring firms to go beyond their personal networks. Eric Becker, Co-Founder of Cresset Capital Management shares how he has leveraged digital networks to raise millions.

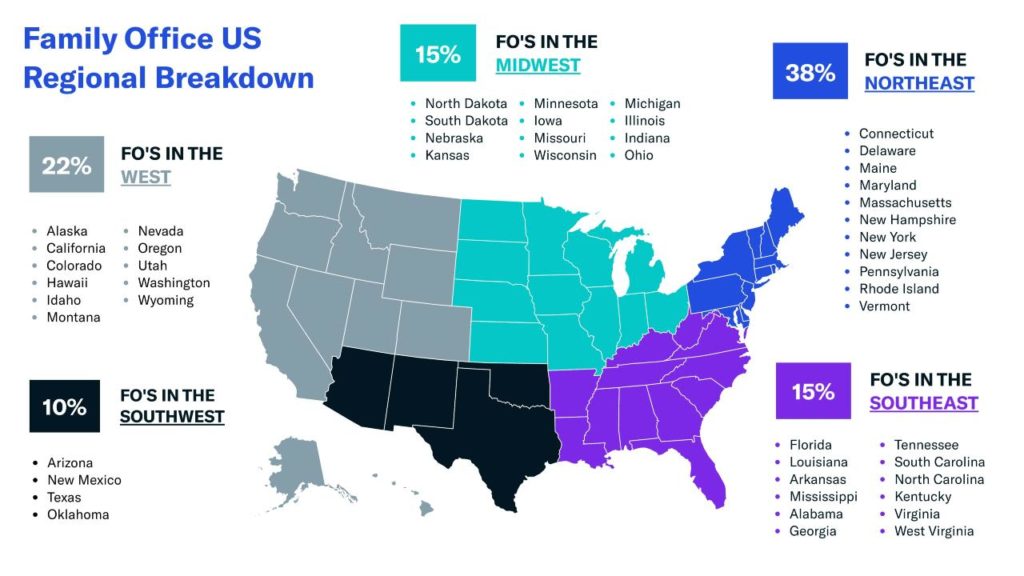

Ernst & Young estimates that there are more than 10,000 family offices operating around the world, with more than half of these offices located in the United States. With the high density of firms offering services to a relatively small slice of the population, staying ahead of the pack can present a challenge.

Family offices typically rely on their personal networks, as well as carefully cultivated professional relationships, to find new investment opportunities. But as the world becomes increasingly globalized, there is increased pressure for these firms to maintain a relationship network that extends globally. In fact, “Global Mobility” was ranked as one of the top five concerns for family offices in a 2019 report by Deloitte.

Cresset is one such firm that is scaling quickly to build what it believes is a differentiated platform for clients. Despite being a fast-growing investment management firm and multi-family office with a diverse investment portfolio, Cresset’s Co-Founder and Co-Chairman Eric Becker realized that to keep delivering value to clients, Cresset would need to expand its reach beyond traditional networks.

The solution? Opportunity Network.

Cresset’s Approach

Cresset has two business units: Cresset Asset Management, a multi-family office, and RIA, and Cresset Partners, which is Cresset’s private investing arm. Both businesses have found success via Opportunity Network.

Since joining Opportunity Network in 2017, Becker and his team have connected with dozens of interested investors. Many of whom have participated in their direct investment platform, Cresset Partners.

Cresset’s innovative approach has supported the firm’s growth. Cresset Asset Management currently has more than $14.8 billion in assets under management and another $1.2 billion in private assets through Cresset Partners as of August 2021. The firm, which is headquartered in Chicago, currently has more than 200 people working out of 10 offices around the United States. Stacked up against the dense list of family offices in the United States, Cresset Asset Management is one of the 25 largest RIAs in the country, as well as the fastest-growing.

Cresset places a heavy emphasis on the continued cultivation and expansion of its network of partners. Partnering with entrepreneurs, operators, and investors to find, source, and invest in a wide variety of interesting opportunities is key. The value that Cresset brings to its clients is that it sits in the middle of this ecosystem and can help curate specific and unique opportunities. Ultimately, Cresset’s value lies in leveraging the insights that the network provides and distilling them down into unique and hard-to-access opportunities.

“Opportunity Network has connected us with other like-minded investors who can bring both capital to opportunities that we’re seeing, as well as opportunities to us,” shared Cresset Partners Managing Director Nick Parrish. “It’s been a very powerful way for us to do that.”

“The people who engage with us are CEOs, founders, entrepreneurs, private investing professionals, and multi-generational families,” added Cresset Partners Associate Director Carly Causey. “We have found that there are multiple areas of mutual interest with introductions from Opportunity Network.”

Success Across the Board

Cresset Partners has found a recipe for success on the digital deal-matching network. From direct investments in the firm’s Qualified Opportunity Zone (QOZ) fund to partnerships that have generated recurring business.

The reason? “The people who we’ve connected with on Opportunity Network are real,” Parrish explains. “There is no ambiguity around why people are trying to connect, so the initial conversations are far more substantive. Connections result in infinite and tangible conversations that tend to yield more activity and less wasted time on both sides.”

One businessman from Florida connected with Cresset and proposed his business as an investment opportunity. “He later became an advisor for us in addition to investing his own wealth with the firm,” explained Causey.

“[Another] gentleman saw a posting for a deal and reached out to us,” continued Parrish. “After speaking with him, we discovered that he’s located in Chicago, and we have several mutual connections. He ended up investing in the posted deal, as well as another opportunity we had open, and became a client of our wealth management business.”

In addition to these cases, Cresset Partners has raised significant capital through Opportunity Network for its real estate program to invest in development opportunities in Qualified Opportunity Zones. The company has found several actionable investment opportunities through connections on the platform. “It’s not uncommon to speak to someone and have them say, “I’d also like to introduce you to my friend/partner/colleague.…,” shared Parrish. “There can be a chain reaction of introductions from these kinds of connections.”

The New Normal

Cresset is well situated to continue its growth despite the uncertainty of the current environment. Although “Global Mobility” is top of mind for the firm, it’s not exactly what you’d call a concern.

“You can find global connections without leaving your living room today,” explained Rose, VP of Business Strategy. “As a result of the experiences of the pandemic, we’re now operating in a hybrid, in-person and virtual era. Opportunity Network expands the virtual reach to investors, entrepreneurs, and CEOs beyond the United States. There is an untapped network of interesting investment opportunities with people who are doing the same thing you’re doing. It’s a great way to bring investors and investment opportunities to you without having to go out and find them.”