Data is only as valuable as the analysis you can draw from it. Discover how tools, such as ITC’s Market Analysis tools, can help you leverage it.

This article will take about 4 minutes to read

To achieve success in business, making the right decisions at the right time is vital. And to make sure the decisions you’re making are the right ones, you need to base them on reliable and comprehensive information. This has never been more true than it is today, as the tumultuous effects of the COVID-19 pandemic make market analysis a necessary part of this process. As Peter Sondergaard, Senior Vice President and Global Head of Research at Gartner, Inc. states:

“Information is the oil of the 21st century, and analytics is the combustion engine.”

The importance of data in decision-making has been proven time and time again. Data and analytics enable companies to create new business opportunities, grow their revenue, predict and analyze trends, and gain other actionable insights. With the pandemic pushing the majority of businesses and customers online, the breadth of data has never been wider. From tracking the needs and desires of your target audience to seeing what your competitors are doing, those who aren’t investing in market intelligence are blinding themselves to invaluable information.

Tools of the Trade

For trade, market and expansion evaluation, and global industry insights, there is nothing better than the International Trade Center’s (ITC) Market Analysis Tools. Consisting of a suite of online aids, ITC aims to make global trade more transparent and facilitate access to new markets for all kinds of businesses. The data is constantly updated and extremely detailed, encompassing over 200 countries/regions, as well as a wide range of industries. Users of the tools can take advantage of this world-class intelligence by understanding supply and demand trends, growing their export figures, identifying opportunities for market and product diversification, and closing favorable international trade deals.

Inside the platform, these analyses have been divided into information sectors or “maps” which display top-notch market information on various sectors.

Trade map

The trade map presents useful indicators on export performance, international demand, and alternative markets as well as the role of competitors from both the product and country perspective.

This is a powerful market analysis tool for business leaders looking to bring their products into a new geographical market. By monitoring international demand as well as competitors, companies can ensure they’re entering the right markets at the right price.

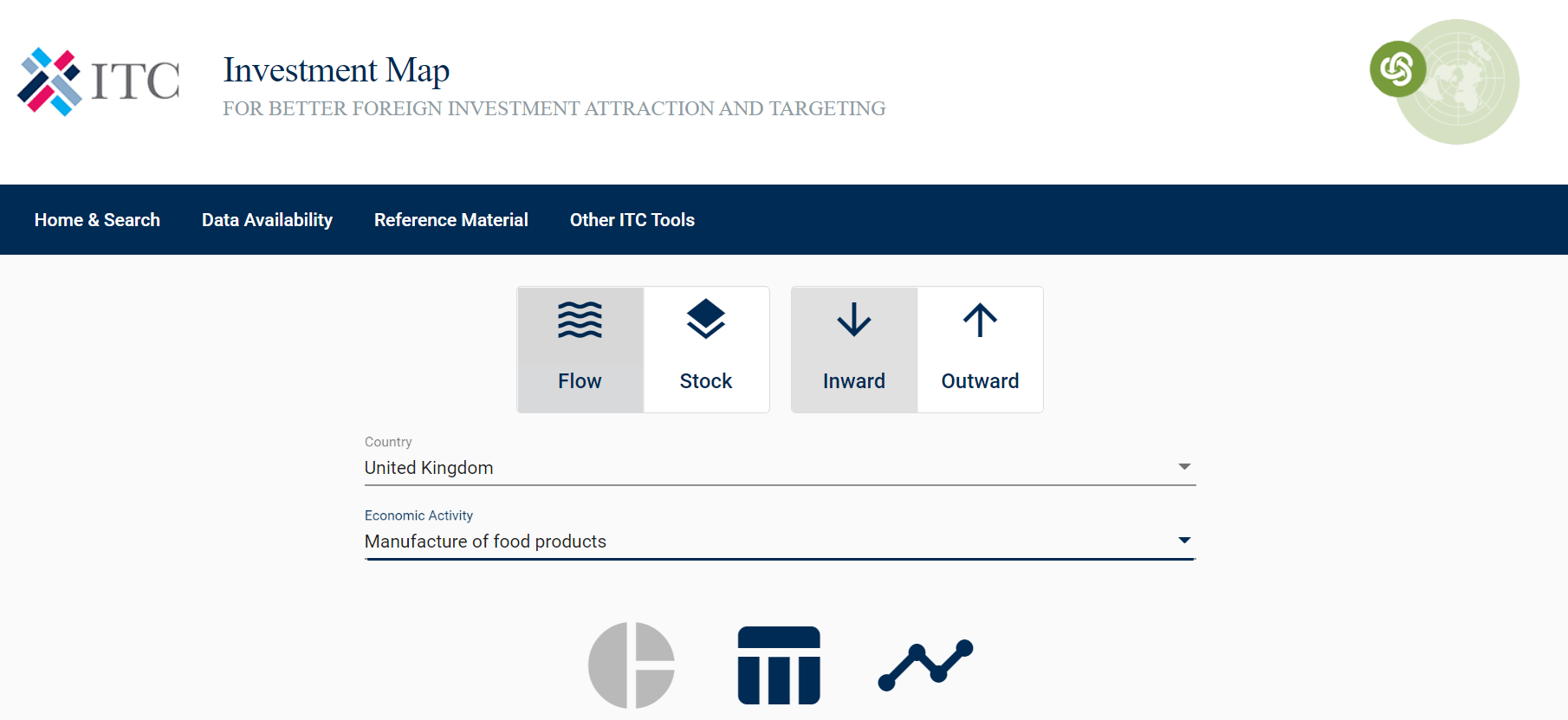

Investment Map

The investment map combines statistics on foreign direct investment (FDI), international trade and market access conditions. By doing so, this tool allows company leaders to analyze opportunities by country, trading partner and industry, and discover any relevant information on activities of foreign affiliates in developing countries and economies in transition.

For investment offices looking to source opportunities internationally, this is a key tool for preliminary due diligence.

Market Access Map

The Market Access Map supports the needs of exporters and importers, trade support institutions, trade policymakers and academic institutions in developing countries. In other words, the tool helps to better understand and analyze relevant market access conditions.

Market Analysis for target geographies is key for companies who are looking to gain share in an international market.

Export Potential Map

The Export Potential Map identifies products, markets and suppliers with, often untapped, export potential. On top of that, the tool sheds light on opportunities for export diversification for 220+ countries and thousands of products.

This tool can be used by companies looking to expand their market by exporting their products to new geographies. In today’s reality where many businesses are struggling to bring products in, this tool can help executives identify needs in foreign markets.

Sustainability Map

The Sustainability Map enables businesses around the world to trade more sustainably. It provides access to a wide range of information related to sustainability initiatives, standards and trends.

Using this tool, executives can source viable solutions to make their business more environmentally friendly, as well as the partners they need to make it happen.

Procurement Map

The Procurement Map combines information on public tenders and contract awards with relevant information on sustainability standards and information on legislation implemented by countries to support women entrepreneurs or SMEs in public procurement.

For firms looking to conduct thorough due diligence and market analysis on potential investments, this map is a great tool.

Data Drives the New Normal

Data is set to be the most highly valued commodity of the next decade. But in truth, data is only as valuable as the analysis you can draw from it. Tools, such as ITC’s Market Analysis tools will be key players in the business ecosystem over the next several years, as they guide global executives to more profitable and sustainable decisions.

Through Opportunity Network, members and non-members alike are being offered complimentary access to this tool in an effort to support business and trade operations worldwide.

Whether you’re exploring expansion opportunities, vetting potential investments, or simply wishing to strengthen your current position, a Market Intelligence tool should be a key part of your process.