Written by Elisa Koek

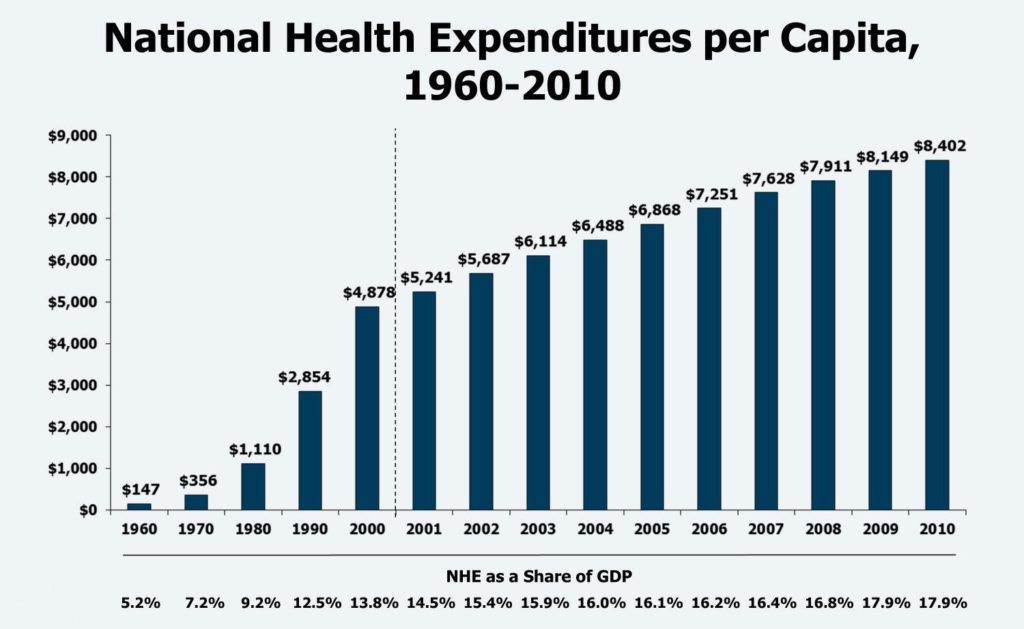

The costs of healthcare in the United States are among the highest worldwide. An MRI scan in the US can easily cost three times as much as the same procedure in Spain, and, on top of that, there is no public healthcare in the US. Since half of the population relies on health insurance through their employer*, this leaves American CEOs with a big responsibility.

According to Michael Waterbury, member of Opportunity Network and CEO of Goodroot, many companies in the US find themselves at the mercy of major health plans. They are unable to provide effective health insurance for their team at an affordable cost which results in expensive and often-inefficient coverage for employees.

How Business Leaders Can Reduce Costs And Increase Effectiveness In Providing Health Insurance

Goodroot provides employers with services to help them reduce the cost of medical and pharmacy care, without sacrificing quality. “Our goal is to reinvent US healthcare one system at a time,” Waterbury says.

With Goodroot, Waterbury is working to reinvent the “broken healthcare system.” The companies within the Goodroot community were all created by industry veterans with decades of healthcare experience. “They were frustrated in their roles — they could see the issues within the system but they weren’t in a position to solve them. Now they are.”

The mission of Goodroot is not easy and Waterbury is aware of that. “The U.S. health system is broken. There are a lot of big companies making a lot of money and the industry is resistant to change. But the patient is suffering. A large part of the industry has lost sight of the patient’s best interest.”

An extensive festering issue: Medical Debt

One of the biggest and most widespread issues in the US is medical debt. “The total medical debt in the United States is $140 billion,” Waterbury says. These debts do not just belong to uninsured people. They also belong to people who had insurance coverage, but maybe not for a particular procedure or their plan deductible is so high it left them in debt.

“It is often not clear what procedures, which drugs, and which doctor is covered by insurance,” Waterbury explains. These inconsistencies result in medical bills of thousands of dollars or even more. “People think they are covered since they have insurance, but six months later they receive a bill and they suddenly owe a lot of money for a procedure they thought would be covered. The medical debt experienced by people can then lead to more issues, like avoiding healthcare out of fear of more debt or mental health issues from stress.”

‘Engage in your employees’ insurance as a CEO’

According to Waterbury, there are many people, organizations, and system issues at fault for the broken healthcare system. However, the patient as well as the employer — the ones that feel the brunt of the broken system in the form of medical bills and claims — also have a role to play.

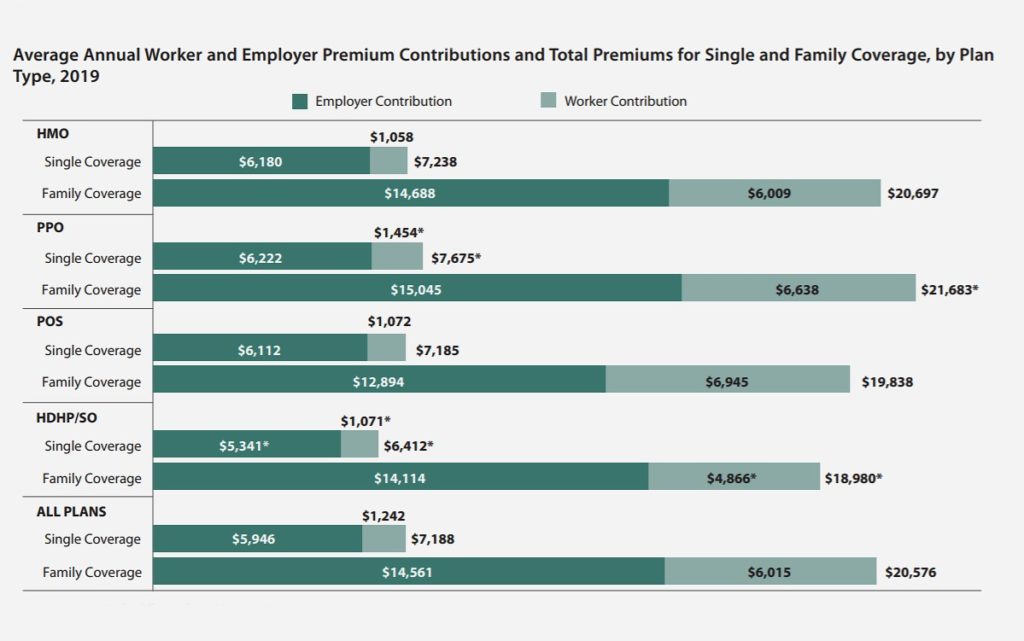

He emphasizes that one of the essential tasks for explorers in providing comprehensive health coverage is to engage in choosing the best insurance coverage for their employees. “Healthcare benefit selection is often a task that is passed to the HR department, but it shouldn’t be only their responsibility,” Waterbury explains. “After payroll, healthcare is usually a company’s second- or third-greatest cost, so it needs to be approached strategically.”

Self-insured alternatives to tailor healthcare benefits

Waterbury recommends that every CEO considers self-insured alternatives instead of feeling forced into choosing a fully insured option. “Smaller companies often feel they don’t have many options than to choose a fully insured benefit solution — but this is always not the case.”

Self-insured companies can tailor their healthcare benefits in ways that can reduce medical and pharmacy costs oftentimes by up to 50 percent. “Most of our solutions focus on self-insured companies because they have so much more control and flexibility,” says Waterbury. “We also help companies that wrongly believe they are too small to be self-insured make the leap and lower their healthcare costs.”

“Engage in your employees’ insurance as a CEO,” Waterbury urges. It not only makes sense for your bottom line, but it’s also the only way to shield your employees from medical debt and help solve this systemic issue.”

What are your employees suffering from the most?

As an example, Waterbury refers to top-performing employees struggling with medical debt. This lingering debt may result in frustration and a decrease in concentration and effectiveness in their work. “These debts now also impact your company’s success,” Waterbury says. “A way to address this is by setting up a fund that helps pay off medical debt for employees. This could improve performance and strengthen relationships with employees at the same time.”

“Access to claims data is another advantage self-insured employers have,” Waterbury adds. Because of privacy concerns, employers can’t simply ask employees about their health issues. However, with anonymized claim data, they can make informed decisions. “If you know what they are suffering from the most and what kind of care is most important to them, you can choose a more effective plan that might even reduce costs,” Waterbury explains.

Reduce pharmacy and drugs costs

Smaller companies feel the burden the most because they don’t have enough employees to give them any leverage with pharmacy benefit managers. CoeoRx, one of the companies under the Goodroot umbrella, is changing this. The company solely focuses on navigating the complex area of pharmacy benefit management, offering solutions that can significantly reduce pharmacy costs for employers. CoeoRx provides both the collective buying power needed to access better pricing and a wider array of options to control pharmacy costs and find savings upward of 30 percent.

‘Smaller companies are typically locked out of accessing innovative services‘

“When it comes to healthcare benefits, a company of 500 employees is referred to as a ‘small company,’ resulting in decreased healthcare choices due to their size,” Waterbury says. “Smaller companies are also typically locked out of accessing innovative services that would result in reduced pharmacy benefit costs. CoeoRx is able to bring the benefits of larger contracts to companies as small as 50 employees so that these benefits, and ultimately savings, are available to more companies in the US.”

To find the lowest price for drugs, Goodroot launched Famulus Health, a technology solution that provides the best price for a specific drug in the US in real-time. This Goodroot company also has access to the lowest cash prices in the country. “You would think that if you had health insurance, it would offer the best prices, but they often don’t,” Waterbury says. “We now know that 70 percent of cash prices are lower than what insurances offer. Famulus closes that gap so that people with insurance take advantage of the best possible price.”

Fix the healthcare system

Goodroot’s mission is to reinvent the American healthcare system. The company is actively supporting talented individuals and entrepreneurs who have ideas on how to improve the existing healthcare system.

A health insurance executive recently called Waterbury ‘the tenth man of healthcare,’ a role that he relishes. “In the Israeli intelligence service, if nine men have a plan, it is the job of the 10th man to poke holes in that plan and suggest alternatives. That’s what we’re doing with American healthcare.”

Waterbury doesn’t expect a big bang or a sudden solution. With 25 years in healthcare, he is aware of the fact that the system cannot be changed overnight or in one fell swoop. However, he has the patience and the passion to tackle this issue one system at a time. “When I look to the future, I see a healthcare system that is not sustainable for my children and grandchildren. We can’t wait. We have to start fixing our healthcare system now.”

Read more about Business Services on Opportunity Network