Digital Disruptors in the financial services industry are reporting a sharp adoption curve. Alberto Constans breaks down what this means for established firms and the industry as a whole.

This article will take about 4 minutes to read

Digital disruptors are impacting industries on a global level. Financial Services is not an exception. Only 8% of companies believe that their business model will remain economically viable through digital conversion. (McKinsey & Co)

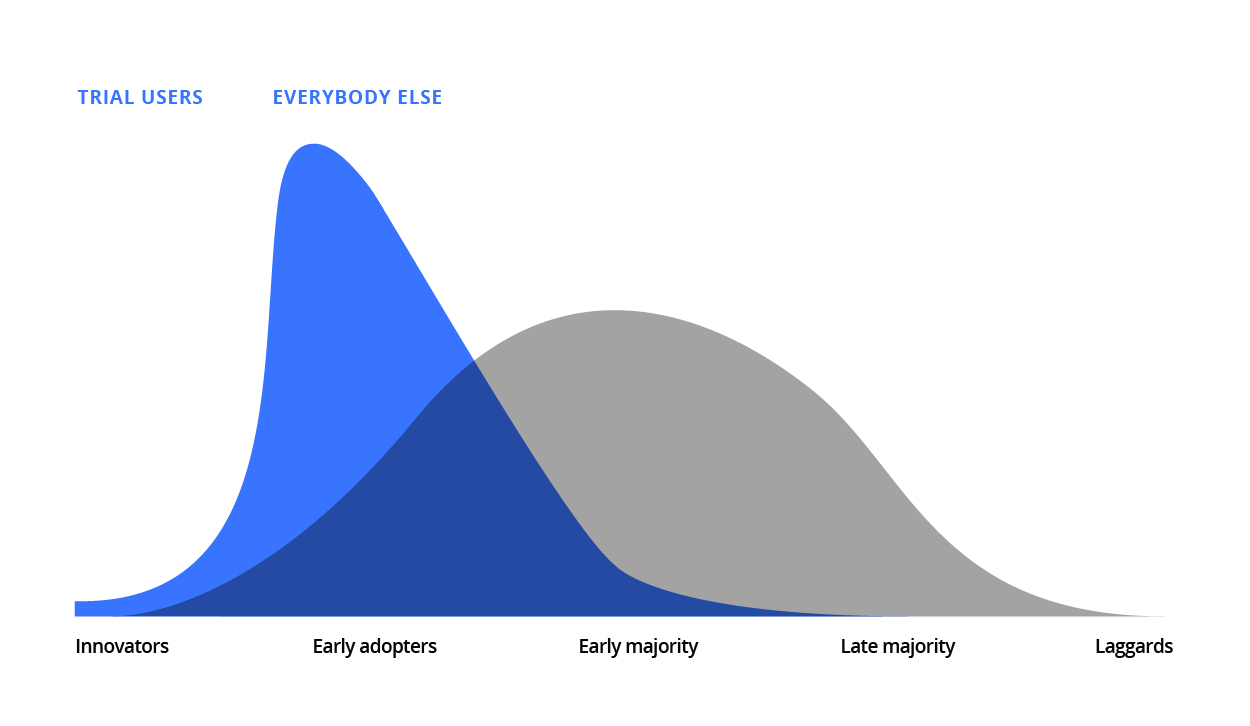

Digital conversion is generating impact at a much higher speed than anything that’s come before. For this reason, the Harvard Business Review has studied and tracked the impact of new digital disrupters. In order to explain the drastic change, they’ve created the “Shark Fin of Adoption” curve.

The Shark Fin Adoption Curve

The graph clearly shows the stark contrast.

In the past, disruptors followed a predictable adoption curve. First, Innovators and Early Adopters would take part. Often, they were the ones testing the first forms of the product. Second, the Early and Late Majorities. They made up the bulk of the curve. Finally, the adoption rate would start to decline, with the Laggards on the tail end.

Today, this pattern has been shortened to two stages. First, the Trial Users. They are the new Early Adopters and are often using the first forms of product or service. Once the final product is marketed and launched, the curve spikes as Everybody Else adopts.

It’s important to note the difference here between adoption and usage. For one thing, the falling adoption rate doesn’t mean that the use of the product is also falling. Google, for example, has a very high usage rate but would likely show a low adoption rate. As most people already use Google, there aren’t many left to adopt the service.

Altogether, the key aspect of this curve is its smooth progress. Predictable adoption allows companies to adapt their products and services to compete with the disruptors.

Today, the Shark Fin Curve isn’t giving them that chance.

The Effects of Digital Disruptors

Disruptors are driving the speed of change. Compared to previous forces, digital disruptors are 10x larger in number, 10% more efficient and 100x more powerful. (Forester)

In the past few years, we’ve seen several areas of the financial sector impacted:

- Exponential growth in Consumer P2P lending

- Digital new entrants offering consumer loans

- New payment alternative providers

- Alternative mortgage financing options

- Low-cost deposit and current account substitutes

- Growth of virtual credit card substitutes

- Brokerage and Investment portals

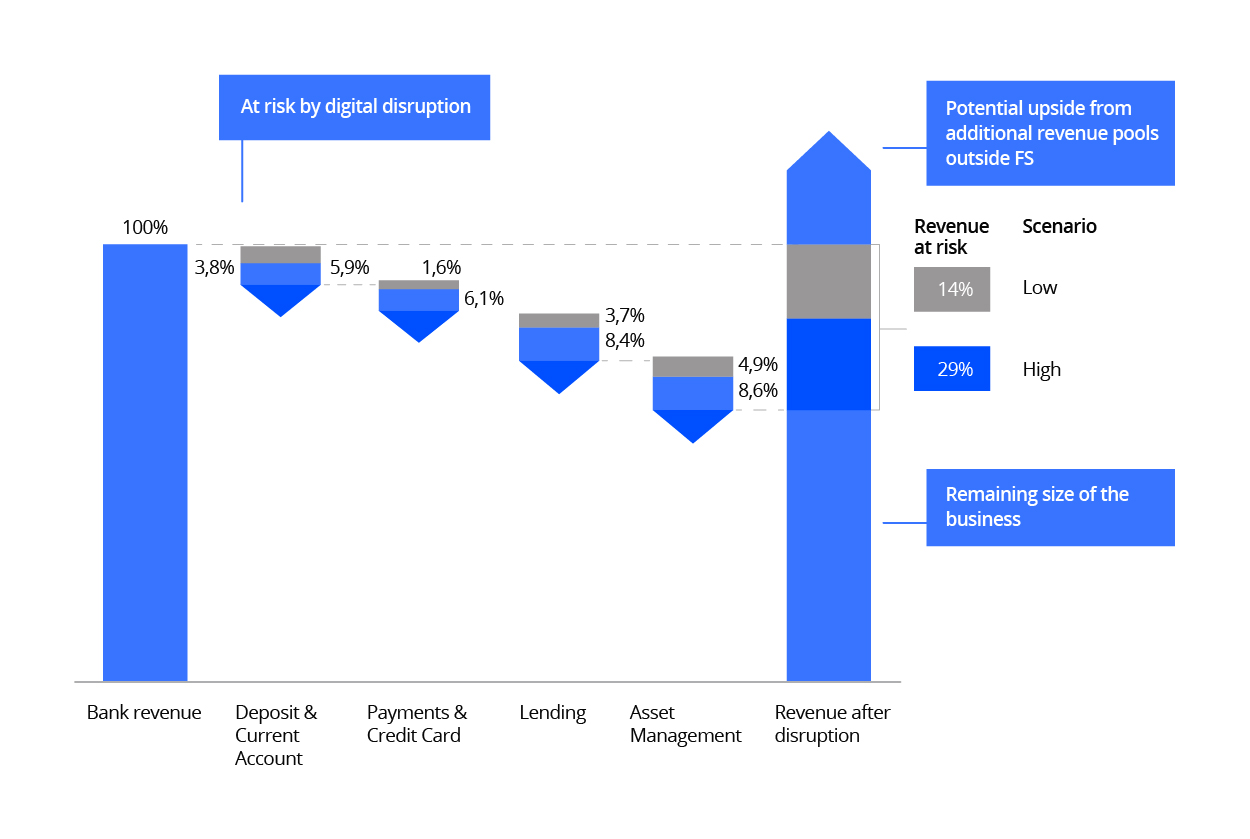

These effects can be seen in the chart below. Notably, Accenture believes that these trends will take almost 30% of the traditional banks’ revenue sources.

At-Risk Sectors

Shifting Business Models

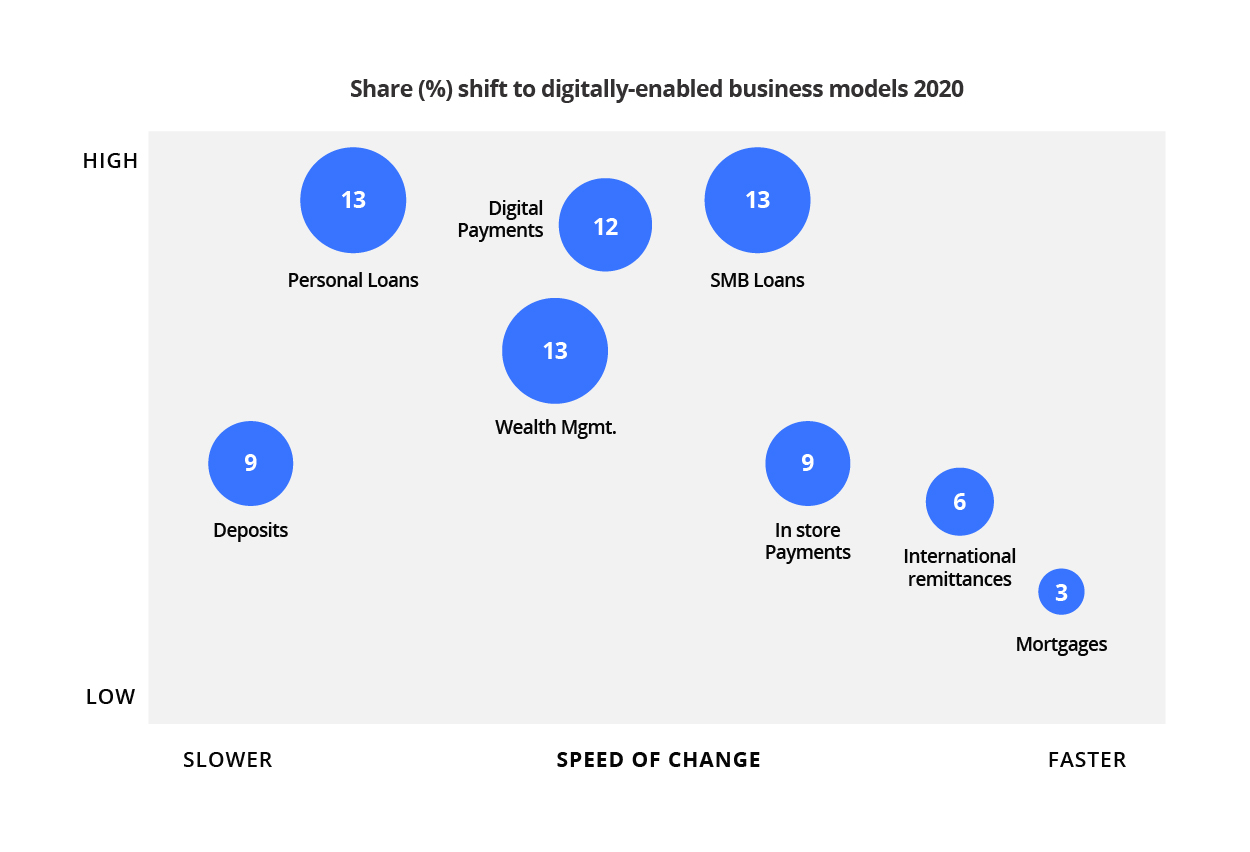

Some large incumbent players are waking up to the threat as well. As a result, companies are shifting their services towards digitally-enabled platforms. Ultimately, the aim is to provide customers with the capabilities they need. Thereby making them less likely to switch to an emerging disruptor.

However, this is often easier said than done. After all, incumbent institutions have strict protocols that make it difficult to create large-scale change. So how can they adapt?

The Keys to Digital Transformation

Incumbent Financial Services need to react to this transformation in three key ways.

1. Commitment around the digital transformation

The organization needs to be fully committed to the proposed changes. The digital conversion must be reflected in the company’s organizational charts, incentive systems, culture, and communication. It’s important to note that this is not a short-term plan. It’s a process that requires continuous communication through all levels of the firm.

2. Setting the right processes and capabilities to drive the strategy execution

Banks will need to aggregate capabilities from across the banking ecosystem. This includes partners, individual developers, FinTechs, technology providers, etc. An open architecture framework will facilitate front-to-back digital integration.

3. Data & Analytics

Lastly, firms will need to focus on data & analytics to support the new processes. Turning data into intelligence will allow the firms to create a customer journey across channels. In turn, helping them to navigate inside the bank more efficiently. Ultimately, data and insights will be a primary source of potential profit.

Collaborators vs. Disruptors

For many firms, a FinTech collaborator is the perfect solution. McKinsey & Company notes how partnerships with would-be disrupters can benefit both companies.

To start, incumbent firms can bypass the hefty processes required for internal conversion. Correspondingly, emerging FinTechs can achieve rapid scaling. By working as collaborators instead of disruptors, both businesses can benefit from the Shark Fin style uptake.

If firms decide to adapt to the digital disruptors, they need to do it quickly. More digitally savvy FinTechs are flooding the marketing place every day. Companies who refuse to adapt risk becoming prey in a sea of digital sharks.

Alberto Constans

Chief Operating Officer at Opportunity Network.

Digital and pragmatic Executive, Investor, and Entrepreneur with 20+ years of experience in the Financial Services and Technology industry. Extremely results-driven. Get things done. Most in my element when rapid change is needed. Being able to develop and implement a strategy even with ambiguous information in a complex, high-pressure environment. Strong expertise in turnarounds and operations, leading global retail and private banking organizations, managing marketing, and sales forces, driving change, and executing new digital strategies. Strong business development track record in technology, e-commerce and Financial Services.