Secure capital for your business

Connect directly with vetted investors and close your round in a timely way.

Find vetted investors to fund your business

Connect directly to funds, family offices & UHNWIs

Post deals anonymously

No commission fees

Raise equity or debt through a

secure and straightforward deal network

Raise equity or debt through a secure and straightforward deal network

Find venture capital

Discuss your venture capital funding directly with the decision-makers.

“By facilitating collaboration & connecting to investment partners, Opportunity Network creates a hub during these challenging times.”

Jackie Iversen

Founder & CEO, Sen-Jam Pharmaceuticals

Find family offices

Connect to decision-makers of family offices to secure your next funding.

“Broadway is not typically a digital business but when the need arose Opportunity Network helped us make that transition by connecting us to resources outside our personal networks.”

Sue Gilad

Founder of Broadway Custom

Connect with Angel Investors

Get in contact with experienced UHNWIs with your shared vision.

“Opportunity Network is a great resource to get investor eyeballs on my business. The platform connected me with skilled investors and allowed me to raise $300,000 of seed capital for my company.”

Joe Tagliente

CEO, Lenrock Management Group

Acquire funding from Private Equity firms

Speak directly with private equity firms looking to deploy capital in companies like yours.

“Opportunity Network supplements my whole travel calendar. I drop meetings in & coordinate with connections ahead of time.”

James F. Kenefick

Managing Partner, Azafran Capital Partners

Find venture capital

Discuss your venture capital funding directly with the decision-makers.

VC firm seeking to invest in renewable energy opportunities in LATAM

We’re a VC firm based in Florida looking for investment opportunities in LATAM. Only start-ups active in renewable energy industry. We invest from seed-stage to IPO and our investments ranges from $500K to $10M.

Latin America

500K-10M

Renewable energies

Amsterdam-based investment group looking to invest in FinTech

Our firm has been around for more than three decades and has a wide portfolio of investments. We’re now looking to invest in businesses active in Fin-Tech, which are in start-up or scale-up phase. Open to both minority and majority investments.

Europe

1-20M

Finance, Tech

VC fund seeks investment in start-up companies

We are seeking minority investment opportunities in start-ups all over the globe. Businesses must have an annual turnover of at least $2.5M. Up to $150M available. Our firm has been providing growth capital to companies in more than 30 industries for nearly two decades.

Any region

Up to 150M

Any industry

Investing venture capital in UK-based tech-companies (up to $30M)

Direct investments or secondary acquisition of shares of UK-based tech-companies. Deal size between $1M – $30M. We are a venture capital firm with broad experience in VC investments in Europe. Looking to invest in businesses before EOY.

UK

1-30M

Tech

“By facilitating collaboration & connecting to investment partners, Opportunity Network creates a hub during these challenging times.”

Jackie Iversen

Founder of Sen-Jam Pharmaceuticals

Italian family office looking to acquire European-based service companies

Family office looking to invest in health and resilient European businesses with min. EBITDA of €5M. Mainly interested in transport, food service, distribution and retail companies. Looking to act quickly. Deal size up to €125M.

Europe

10M-125M

Professional services

International family-office seeks to deploy $25M capital for acquisitions

We are a global group of family office investors looking to acquire companies in the US. Max. deal size is $25M. Only interested in majority investments. Interested companies need to have a revenue of at least $5M and 10% EBITDA.

US

5-25M

Any industry

Find family offices

Connect to decision-makers of family offices to secure your next funding.

“Broadway is not typically a digital business but when the need arose Opportunity Network helped us make that transition by connecting us to resources outside our personal networks.”

Sue Gilad

Founder of Broadway Custom

Family office investors looking to acquire F&B companies

Group of investors from a family office seeking to acquire businesses in the Food & Beverages sector. Open to a variety of verticals and businesses anywhere around the world. Our current portfolio includes 22 companies in 4 continents.

Any region

50M-500M

Food & beverages

Family office seeking to invest in businesses in Africa and Asia

With decades of experience buying, building and nurturing companies, we are now looking to invest in businesses based in Africa in Asia. We really believe in the potential of these continents. Looking to invest $5M – $20M.

Africa, Asia

5-20M

Any industry

Connect with Angel Investors

Get in contact with experienced UHNWIs with your shared vision.

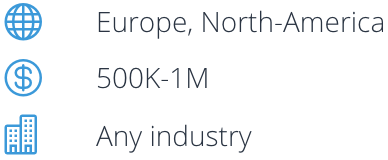

Private investor looking to acquire start-ups in Europe or US

Succesfull entrepreneur, who sold four venture-backed companies to public companies, is looking to invest in start-ups in the US or Europe. Any industry, although I have a strong preference for tech start-ups. Deal size anywhere between 500K-1M.

Europe, North-America

500K-1M

Any industry

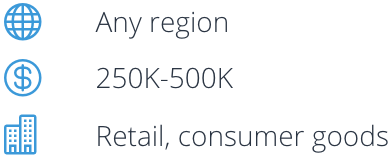

Tokyo-based investor looking to diversify investment portfolio

I’m an angel investor based in Japan, with a succesfull track record and currently owning stakes in 7 companies. Now looking to invest in early-stage companies, within the retail or consumer goods industry. Seeking 10-25% of the shares.

Any region

250K-500K

Retail, consumer goods

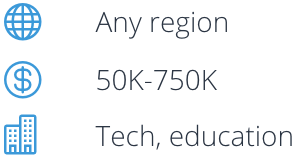

Experienced strategic investor financing edu-tech companies

I have over 35 years of experience as an angel investor, mainly working with companies in the knowledge economy. Now looking to invest in edu-tech companies. I consider myself a growth accelerator and will also gladly provide strategic advice.

Any region

50K-750K

Tech, education

Seed stage investor seeking investment in startups in the US

I’m a private investor interested in seed stage investments. I exclusively invest in startups based in the US, but I’m industry agnostic. Typical investment is 750K-1.5M. I have invested more than 12M in 16 companies.

US

750K-1.5M

Any industry

“Opportunity Network is a great resource to get investor eyeballs on my business. The platform connected me with skilled investors and allowed me to raise $300,000 of seed capital for my company.”

Joe Tagliente

CEO, Lenrock Management Group

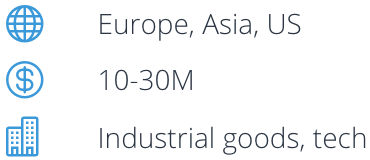

London-based PE firm looking to invest in Industrial & Tech sector

We are a London-based private equity firm looking to invest in technology and/or industrial companies in Europe, Asia or US. Deal size $10-30M. We do minority deals and control buyouts. Looking for companies with growth potential.

Europe, Asia, US

10-30M

Industrial goods, tech

Private equity seeks to invest in companies in Vietnam and Thailand

We are one of the leading private equity firms in Asia. Now seeking to expand our portfolio by investing in businesses in Vietnam and Thailand. Any industry. Min. revenue $5M with an EBITDA of >10%. Looking to invest between 2.5-8M.

Vietnam, Thailand

2.5-8M

Any industry

Acquire funding from Private Equity firms

Speak directly with private equity firms looking to deploy capital in companies like yours.

“Opportunity Network supplements my whole travel calendar. I drop meetings in & coordinate with connections ahead of time.”

James F. Kenefick

Managing Partner, Azafran Capital Partners

Private equity firm dedicated to supporting businesses in LATAM

We offer investment, management solutions and strategic advice for the consolidation and growth of businesses in Latin-America. We can add both debt and equity to your company. Our goal is to become a long-term partner for entrepeneurs.

Latin-America

1-5M

Any industry

Experienced PE seeks to deploy $30+M in tech companies

Well-established PE firm with strong financial backing is seeking investments in tech companies worldwide. Minimum ticket size is $30M. We’re open to both majority and minority stakes. Target companies: min. EBITDA $5M.

Any region

30M+

Tech

VC firm seeking to invest in renewable energy opportunities in LATAM

We’re a VC firm based in Florida looking for investment opportunities in LATAM. Only start-ups active in renewable energy industry. We invest from seed-stage to IPO and our investments ranges from $500k to $10M.

United States

10-50M

Finance

VC firm seeking to invest in renewable energy opportunities in LATAM

We’re a VC firm based in Florida looking for investment opportunities in LATAM. Only start-ups active in renewable energy industry. We invest from seed-stage to IPO and our investments ranges from $500k to $10M.

United States

10-50M

Finance

VC firm seeking to invest in renewable energy opportunities in LATAM

We’re a VC firm based in Florida looking for investment opportunities in LATAM. Only start-ups active in renewable energy industry. We invest from seed-stage to IPO and our investments ranges from $500k to $10M.

United States

10-50M

Finance

Capital raise opportunities are only available to members. Join the network to view and connect.

VC firm seeking to invest in renewable energy opportunities in LATAM

We’re a VC firm based in Florida looking for investment opportunities in LATAM. Only start-ups active in renewable energy industry. We invest from seed-stage to IPO and our investments ranges from $500k to $10M.

United States

10-50M

Finance

VC firm seeking to invest in renewable energy opportunities in LATAM

We’re a VC firm based in Florida looking for investment opportunities in LATAM. Only start-ups active in renewable energy industry. We invest from seed-stage to IPO and our investments ranges from $500k to $10M.

United States

10-50M

Finance

VC firm seeking to invest in renewable energy

We’re a VC firm based in Florida looking for investment opportunities in LATAM. Only start-ups active in renewable energy industry.

United States

10-50M

Finance