Securing the future of my business

Find M&A opportunities or buyers for your company in one safe environment.

Acquire, sell or merge your business on a secure and simple network

Confidential deal sourcing

No commission fees

Verified network with no intermediaries

Connect directly to the right opportunities for your business

Connect directly to the right opportunities for your business

Acquire a company

Find companies that meet your investment mandate and deploy your capital efficiently.

“After 15 years of success in Spain, we are moving towards expansion in North & Latin America. Opportunity Network is helping connect us to relevant contacts and support our expansion.”

—

Marc Buil

Global Director, Artika

Sell my company

When the time comes to sell, connect directly with interested buyers and skip the intermediaries.

Find merge & acquisition opportunities

Close strategic business acquisitions directly with business owners and principal decision-makers.

“With Opportunity Network, you know that your brand philosophy, your image, and your products are valued and taken care of.”

—

Sara Navarro

CEO & Designer

Buy or sell start-ups

Browse or post unique acquisition deals for startups and early-stage businesses.

Acquire a company

Find companies that meet your investment mandate and deploy your capital efficiently.

Sale of fast-growing and highly profitable B2B consulting firm

Unique opportunity to acquire consulting firm with a $7M+ revenue. 1.7x industry average EBITDA. Highly profitable and very professional team. Asset-light and debt-free. Financial information can be provided upon request.

Canada

15-20M

Professional services, Tech

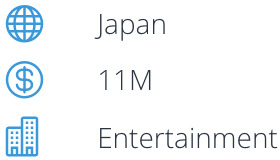

Film & Music rights management company for sale ($11M)

Our company, based in Japan, is one of the largest certified rights management companies in Asia for the online market. We’re selling our business to investors looking to achieve further growth in an upscale market.

Japan

11M

Entertainment

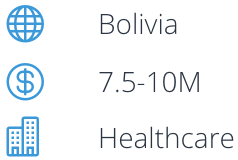

Multi-purpose private healthcare facility for sale (located in Bolivia)

Our company has been operating a major multi-purpose medical center in La Paz, Bolivia, since 1994. We are looking to sell the company partially or entirely. Annual revenue is $4M. Great investment opportunity in a profitable business.

Bolivia

7.5-10M

Healthcare

Selling well-established logistics and transportation company

Operating for 45+ years in the European market, our company is for sale. We have international clients. Revenue $6M, EBITDA €800K. Only looking for buyers who are willing to buy the company as a whole, no minority/majority selling.

Europe

10-15M

Transport, logistics

Main shareholder looking to sell stakes in construction company

I own 65% of a California-based construction company with a 2019 revenue of $8.7M, EBIDTA 900K. Looking to sell my shares to an investor willing to help the company grow further. Specialised in commercial buildings.

US

8-10M

Construction

“After 15 years of success in Spain, we are moving towards expansion in North & Latin America. Opportunity Network is helping connect us to relevant contacts and support our expansion.”

—

Marc Buil

Global Director, Artika

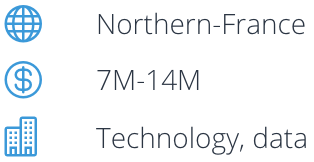

We seek to buy data and information management company in France

We’re a UK-based IT company looking to buy a data and information management businesses in Northern-France (Lille, Paris, Reims). Minimal revenue $7M. The objective is to expand our business to the French and Belgian market.

Northern-France

7M-14M

Technology, data

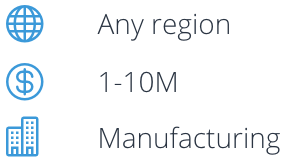

Private equity firm looking to buy electric bicycle manufacturer

Company with almost 60 years of experience manufacturing bicycles wants to buy other business in the same market. Goal is to raise market share. Only electric bikes. If you want to sell your company, please reach out to us.

Any region

1-10M

Manufacturing

Sell my company

When the time comes to sell, connect directly with interested buyers and skip the intermediaries.

Looking to buy an environmental consulting firm

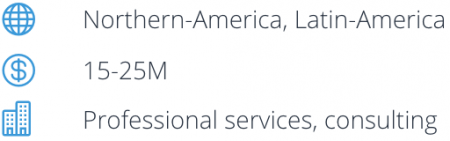

We are a leading consulting firm in the US, looking to expand our business range. Interested in buying an environmental consulting firm in the US, Canada or LATAM. Min. turnover of $10M and EBIDTA of > 10%. Investing before EOY.

Northern-America, Latin-America

15-25M

Professional services, consulting

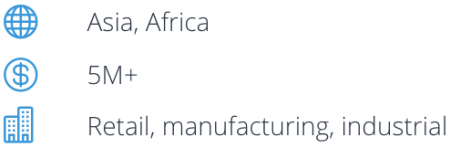

Family-office interested in acquiring businesses in Asia or Africa

Looking for high-growth potential companies to buy. Open to a variety of verticals within retail, manufacturing and industrial. Min. investment is $5M. Minimum EBITDA of $500K. Only looking to invest in established companies.

Asia, Africa

5M+

Retail, manufacturing, industrial

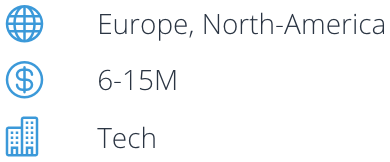

Seeking to buy majority shares (>51%) in a tech company

With many years of experience in the sector, we are looking to acquire at least 51% of a company in Tech, located in Europe or North-America. Min. turnover of $15M. No interest in buying the company, just a majority of the shares.

Europe, North-America

6-15M

Tech

Find merge & acquisition opportunities

Close strategic business acquisitions directly with business owners and principal decision-makers.

Polish coating company looking for mergers or partners

We’re a Poland-based company, specialised in industrial coating. 40+ yrs. of experience. Looking to merge with other companies in the industry. Our revenue is around $16M and we’re looking for mergers or partners with similar revenues.

Any region

10-50M

Industrial goods

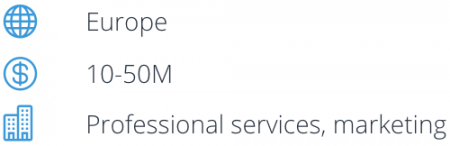

Looking for acquisition or merger or JV with a digital marketing agency

We are a media company looking to buy, merge or joint venture with a digital marketing agency. Our preference is to JV or to merge, but buying a company would also be an option. Min turnover of $12M required.

Europe

10-50M

Professional services, marketing

$13M F&B consulting company in Boston considering acquisition

We’re open to both strategic acquisition and private equity acquisition. We have enterprise clients in the F&B industry. EBITDA 1.8M. Please reach out to us if you’re interested in buying companies in the US.

US

20M+

Business services

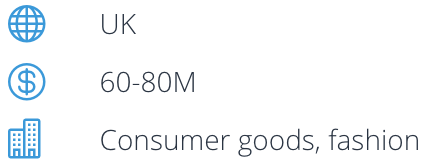

50-yr-old clothing distributor looks for acquisition or merger

Holding with clothing distribution is looking for a merger with a company like ours or acquisition of a businesse. Well-capitalized, very experienced and looking to increase our revenue. Revenue similar to ours requiered: around $70M.

UK

60-80M

Consumer goods, fashion

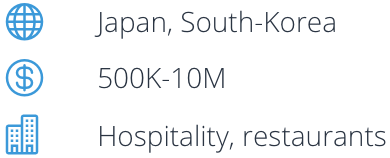

Established restaurant group looking to M&A in Japan and Korea

We’re a holding with 20+ restaurants and 35+ bars in our portfolio. Looking for M&A’s in South-Korea and Japan. Investment deals between $500K and $10M. Preferably organic food. We have been in business since 1993.

Japan, South-Korea

500K-10M

Hospitality, restaurants

“With Opportunity Network, you know that your brand philosophy, your image, and your products are valued and taken care of.”

—

Sara Navarro

CEO & Designer

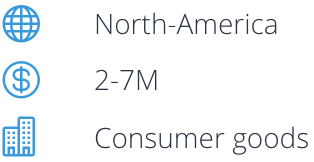

Acquiring early-stage consumer goods companies in North-America

We are a group of investors looking to acquire companies in the consumer goods industry, founded after 2015. High potential growth potential required. Looking to invest $2M – $7M. Looking to keep the team and keep on growing.

North-America

2-7M

Consumer goods

Very high-potential Edu Tech start-up for sale in Estonia

We’re managing a start-up founded in 2017 in Tallinn, Estonia, in the online education business. Looking to sell our start-up this year to investors. Good opportunity to make it grow. Great potential, low costs. We’ll provide financial information.

Estonia

11M

Education, Tech

Buy or sell start-ups

Browse or post unique acquisition deals for startups and early-stage businesses.

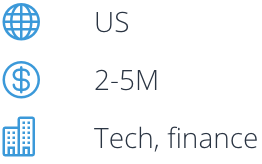

Fintech investors looking to acquire startup in US

Small multinational headquarters in Brooklyn, NYC, looking to buy a startup in the US. We specialise in online payments and are growing rapidly. Looking for startups focused on digital payment platforms. We are acquiring businesses with a total investment $2-5M.

US

2-5M

Tech, finance

Selling start-up in fashion industry

We’re a group of young designers. Founded our own luxury fashion brand in 2016. We’re now selling our company in early stage in order to raise capital to skyrocket its growth. Huge potential. We will available to stay on the team after acquisition, if requested.

Australia

3M+

Fashion, apparel

Private equity firm looking to buy promising start-ups in Europe

We’re buying start-ups in Europe for an investment fund. Our deal ranges vary between €5M and €50M. Minimum EBITDA of 5%. No industry restraints. Looking to act quickly. No interest in minority investments, only complete acquisitions.

Europe

5-50M

Tech

VC firm seeking to invest in renewable energy opportunities in LATAM

We’re a VC firm based in Florida looking for investment opportunities in LATAM. Only start-ups active in renewable energy industry. We invest from seed-stage to IPO and our investments ranges from $500k to $10M.

United States

10-50M

Finance

VC firm seeking to invest in renewable energy opportunities in LATAM

We’re a VC firm based in Florida looking for investment opportunities in LATAM. Only start-ups active in renewable energy industry. We invest from seed-stage to IPO and our investments ranges from $500k to $10M.

United States

10-50M

Finance

VC firm seeking to invest in renewable energy opportunities in LATAM

We’re a VC firm based in Florida looking for investment opportunities in LATAM. Only start-ups active in renewable energy industry. We invest from seed-stage to IPO and our investments ranges from $500k to $10M.

United States

10-50M

Finance

M&A opportunities are only available to members. Join the network to view and connect to all opportunities.

VC firm seeking to invest in renewable energy opportunities in LATAM

We’re a VC firm based in Florida looking for investment opportunities in LATAM. Only start-ups active in renewable energy industry. We invest from seed-stage to IPO and our investments ranges from $500k to $10M.

United States

10-50M

Finance

VC firm seeking to invest in renewable energy opportunities in LATAM

We’re a VC firm based in Florida looking for investment opportunities in LATAM. Only start-ups active in renewable energy industry. We invest from seed-stage to IPO and our investments ranges from $500k to $10M.

United States

10-50M

Finance

VC firm seeking to invest in renewable energy

We’re a VC firm based in Florida looking for investment opportunities in LATAM. Only start-ups active in renewable energy industry.

United States

10-50M

Finance