In the final issue of the Special Report Series, Azafran Partners highlight the intrinsic value and importance of combining a founder’s perspective with a global network of experts as principal ingredients for success.

This article will take about 4 minutes to read

About the Series

Azafran Capital Partners is an early-stage venture fund. Their investments ($2 million to $8 million) focus on companies using deep and machine learning, emphasizing voice, acoustics, and imagery tech in the health, wellness, IoT / automation, and enterprise spaces.

Only a few months ago, managing partner and Opportunity Network member, James Kenefick, was travelling constantly. Building his network by meeting with companies and attending conferences around the world. Now, like everyone else, he’s finding new ways of doing business from home.

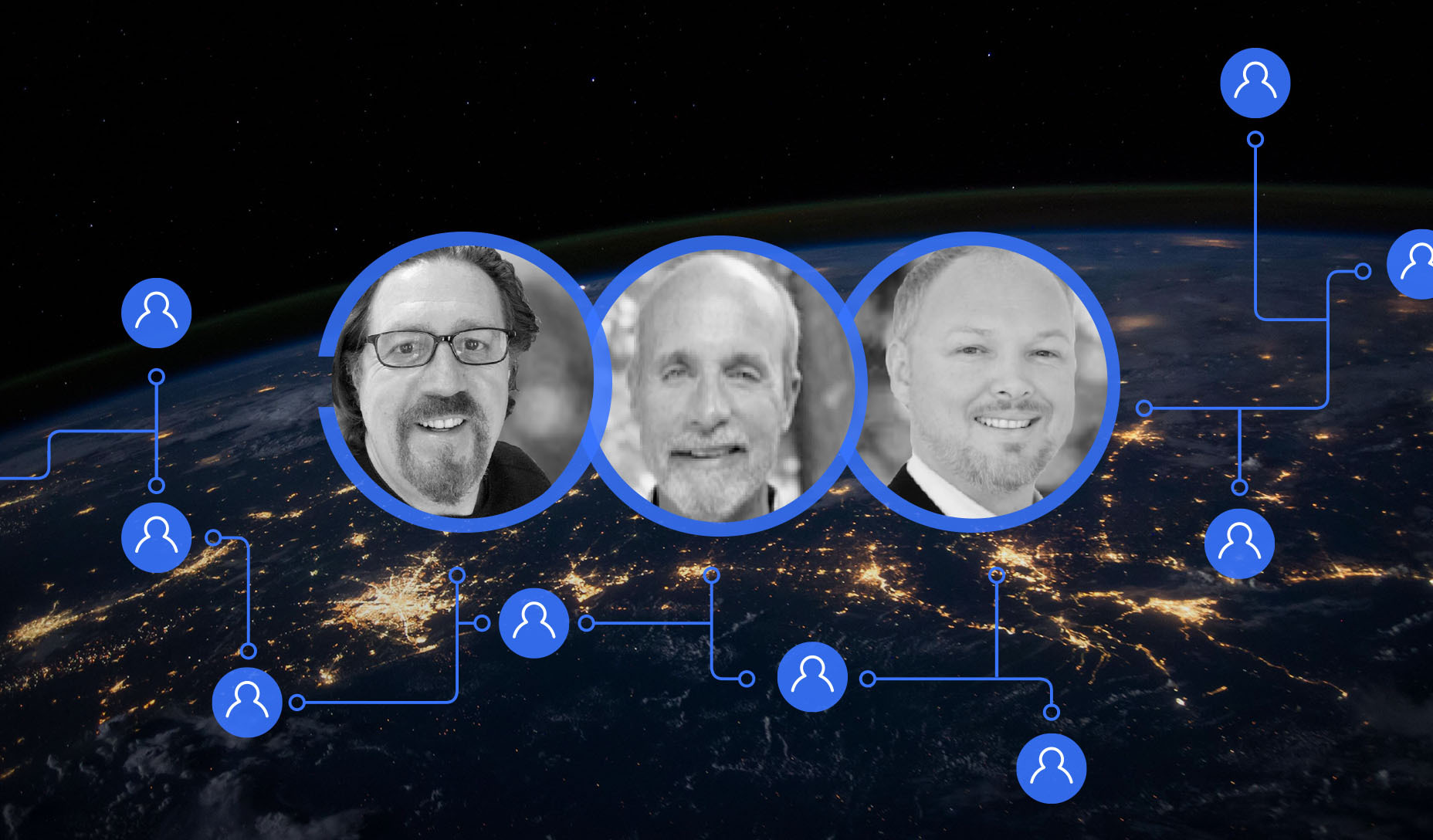

In this three-part series, Kenefick and his colleagues at Azafran Capital Partners, Jock Percy and Martin Fisher, will share their global perspectives on the current state of the investment market, the potential for tech, and the power of the network.

Part three focuses on the Azafran team and network. Our founder’s perspective as operators, technologists, and investors using our personal and digital networks. We discuss how this combination lays the foundation for finding, evaluating and investing in innovative companies.

Rather Listen?

This series is accompanied by a podcast discussing the main topics of each issue.

Azafran INSIGHTS Podcasts · Azafran INSIGHTS Special Edition Podcast, Part Two

You can’t fast-track experience

If you want to start fly fishing, no amount of books or videos will net that first rainbow trout. You need to go through the hours of trudging through mud, untangling fishing line, mending hook cuts, as well as making cast after cast. There is no substitute for on-the-ground learning.

Investing in early-stage companies has a similar learning curve. The perspective gained from spending years in the trenches can’t be fast-tracked. From understanding the market problem to assembling the team to productizing the solution to the problem. Continuing with getting funding, going to market as well as identifying the exit trajectory.

Some say it takes a degree of insanity to go through the startup process. Melding your passion with an incredible amount of faith takes stamina and fortitude as well as vision. In summary, not everyone is capable of it.

For Azafran, this insane journey is part of our DNA. Our General Partners have started and operated dozens of companies. Totalling 13 exits, 120 M&As, and the creation of $9 billion in enterprise value between them.

Factoring in the Network

Just as important as our experience is the global network. Something which we have been building for decades alongside all our ventures. Azafran’s network now reaches all corners of the globe with tens of thousands of experts, CEOs as well as founders at our fingertips.

When researching and compiling background data for this issue, our team found some surprising statistics. Only 40% of GPs at top-tier VC firms have direct experience as startup founders. Additionally, less than 20% of the GPs have experience as founders among the rest of the firms surveyed. In comparison, 100% of Azafran’s GPs are founders and 50% of the entire Azafran team are founders.

This dynamic is particularly important in early-stage investment. Young companies need hands-on assistance in a number of areas. This includes building out the team, productizing, market development, connecting with partners and supply chain.

Source: TechCrunch article, Entrepreneurial Experience Separates Top VCs From Other Investors

“Investors who have worked as founders and C-level executives have an inside perspective on what it takes to make a company scale and succeed. This expertise is difficult to replicate in any other way. The second factor is the personal network that comes from working inside an entrepreneurial company. Founders are likely to prefer to partner with an investor who has been on a similar journey.”

TechCrunch

So what does it take to be a great early stage VC investor? The Azafran Formula includes the following key steps.

- Deal flow from established networks, as well as thorough research

- Investment instincts, cultivated from starting and building dozens of startups

- A global network of experts from every niche and geography

The difference-maker: A Global Network

While the Azafran team is intentionally lean, we surround ourselves with thousands of experts from every possible market niche. A network we utilize with each company. From the due diligence phase through to growth and exit.

The key to this global network is the Azafran Partner’s decades-long membership in the Young Professionals Organization (YPO). YPO is comprised of founders and CEOs from all over the world. Together, they lead businesses and organizations contributing $9 trillion USD in annual revenue, equivalent to the GDP of the 3rd largest global economy. YPO members engage in peer learning, training, as well as experiences that build strong connections.

YPO also grants its members access to the private online deal matching platform, Opportunity Network. Opportunity Network connects 28 000+ CEOs, C-Level executives and investors in over 130 countries. Through these collective networks, we’re able to connect with proven entrepreneurs and executives with deep domain experience. Ultimately helping us to efficiently evaluate and grow each investment.

Optimizing the Benefits

We call this the ‘network effect.’ We are able to place expert voices into active diligence alongside our deal team and researchers. These connections intimately know and understand the prospective investment and associated market. They provide a critical role by offering an independent view of the prospective investment. Occasionally, they may even go on to take an active board/advisory role in that company. Assisting via mentorship with strategy, business development, partnerships, and governance.

James F. Kenefick

Managing Partner at Azafran Capital Partners

Jock Percy

Partner at Azafran Capital Partners

Martin Fisher

Partner at Azafran Capital Partners