The investments of today determine the power of tomorrow and this is exactly what we see when it comes to renewable energy investment. Since 2010, global investments in green energy have increased significantly.

The costs of solar and wind power have reduced by 85% and 49% respectively, making green energy an attractive investment alternative to traditional energy sources.

With a growing demand to diversify our energy sources, especially given the current conflict in Ukraine, renewable energy seems to be a solid bet when it comes to investment opportunities. However, as we all know, every investment involves risks. Timing, expertise, and the right connections are crucial when it comes to investing in renewable energy.

In this article, we will discuss the various aspects of renewable energy investment with Fope Oluleye. Oluleye is an entrepreneur, CEO, and investor. His company, Zenith Guild Group, has interests in real estate, renewable energy, and venture capital. They partnered with PASH Global, an impact investor, and developer of clean power projects worldwide.

In this article, we will address:

- 1. The best way to approach new investment opportunities

- 2. What are things to consider before investing in renewable energy?

- 3. What roles do de-risking, insurance, and a power purchase agreement (PPA) play?

- 4. The right time to start investing

- 5. Which locations have the most potential in terms of return on investment?

1. The best way to approach new investment opportunities

At Zenith, we consider every opportunity in wind or solar projects that crosses our path. However, it is highly important to do this with a rigid framework for the assessment of the opportunities and to have the expertise to perform thorough due diligence. When executing a project and adding value to an investment, we approach every opportunity with an entrepreneurial flair to make sure we can get the best returns from the project.

I believe that entrepreneurial enthusiasm combined with well-considered risk analyses are critical aspects of investments in innovative products like renewable energy.

2. What are things to consider before investing in renewable energy?

Impact – In terms of the impact, it is best to look for sustainable projects that have a socio-economic impact. Being heavily orientated on Environmental, Social, and Governance means that our goals align with the view to create a positive impact on the immediate environment to people, society, and the public: projects that create jobs, improve livelihoods, and create sustainable power that can empower communities.

Risk – Our risk appetite is strictly governed by a protocol that allows us to look at projects and deals to minimize any risk. The main types of risk you should seek to mitigate through your structuring are:

1. Project risk

2. Country risk

3. Currency risk

By employing a set of structuring, financial engineering, and insurance wrappers alongside legal structuring you can make sure income and returns are realized safely.

Return perspective: When looking at projects to finance, it is important to focus on projects that could result in a double-digit return. To achieve this we evaluate both operational and development projects that are geared towards this with an average income profile of 10 or more years.

We look to enhance returns through a combination of in-house management, financial engineering, and strategic relationships with other companies that can provide value through technology or partnerships beneficial to the underlying project.

‘Having project partners with underlying experience is crucial’

Double-digit returns in emerging markets are very achievable if examining the enormous need for power combined with the level of investment needed to develop a project. The most important thing is having project partners that have an underlying experience of the market across LATAM, Africa, and Asia. We have a combined track record of executing and developing c.20 GW of renewable energy projects across these regions.

3. What roles do de-risking, insurance, and a power purchase agreement (PPA) play?

- De-risking

De-risking is a very important tool. We always make sure that we commit to the investment and bring investors into long-term projects. This can also apply to projects that are at the development stage to ensure that the preliminary information and planning details are sound.

We believe in selecting the appropriate team to handle the different aspects of the projects, from operation and maintenance to structuring and continuance. A long-term view of investing is highly important: we are often involved in a project for the duration of its lifetime. This is usually 10 years, hence why de-risking is essential to avoid anything that can reduce cash flows in the long term or affect the viability of the project.

- Insurance

Insurance is very important to mitigate risk. Having insurance wrappers to reduce country risk and ensure that payments are received adds a greater layer of protection to project life. In addition, this approach makes our co-investors feel more comfortable with project metrics.

- Power Purchase Agreement (PPA)

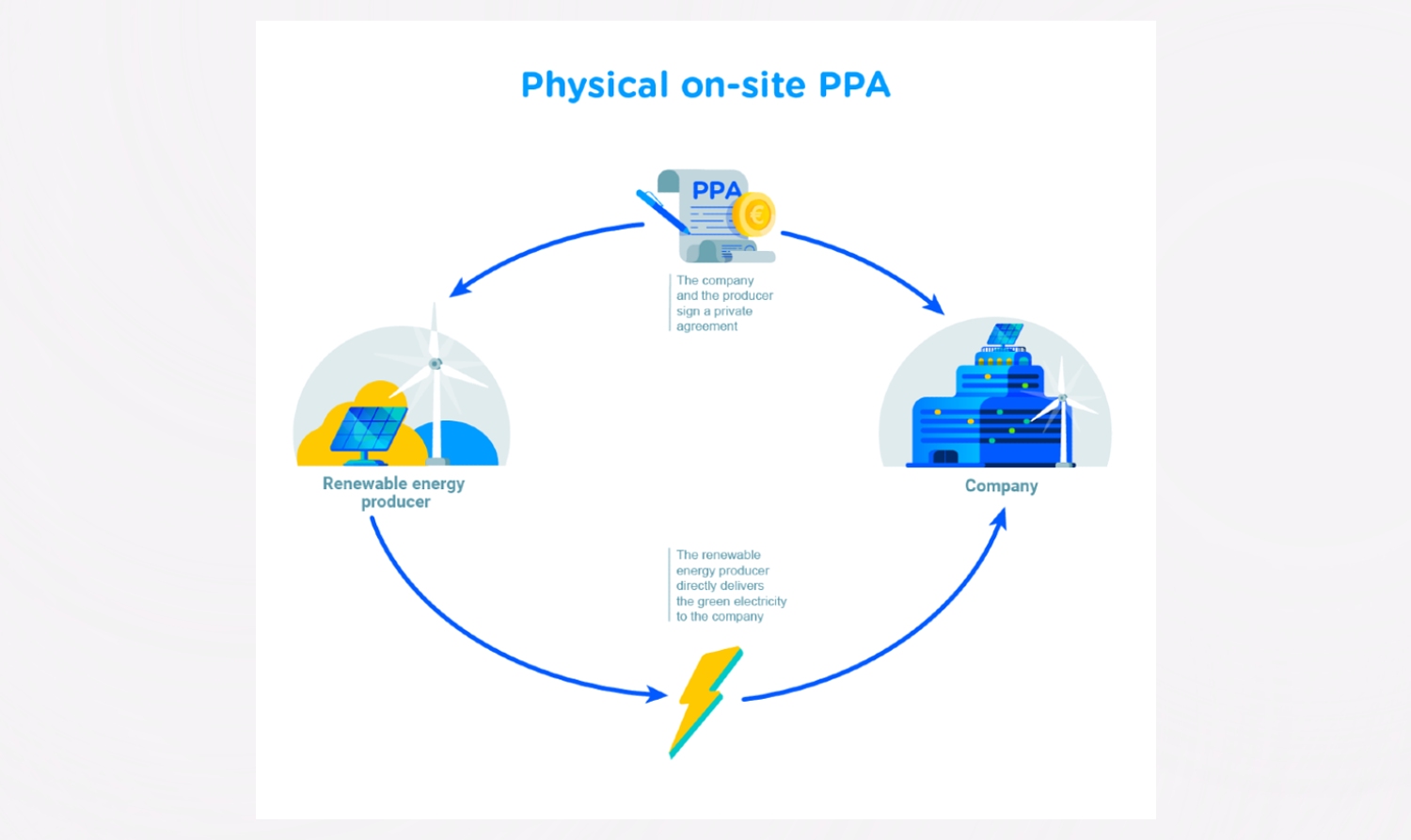

A PPA is a contracted agreement that guarantees that the Off-taker will pay a contracted amount for a number of years. The greater the length of time, the greater security of the project and it is a good enabler for allowing project debt.

4. The right time to start investing

Considering the recent developments in Russia and Ukraine that are heavily impacting trade, oil prices, and infrastructure, now more than ever there is a sense of urgency when it comes to providing alternatives to produce power. Renewable energy presents an excellent proposition in the current climate with the world’s agenda on the net-zero pledge. Many companies and governments are looking at corporations to show emphasis on how their operations subscribe and adapt to this energy.

The reduced development costs of setup in solar and wind energy make renewable energy even more attractive in terms of investment and long income profiles. This combination of factors and the fast adoption of using renewable energy as an alternative means to produce power and provide sustainable processes shows that the industry will only continue to grow massively.

5. Which locations have the most potential in terms of return on investment?

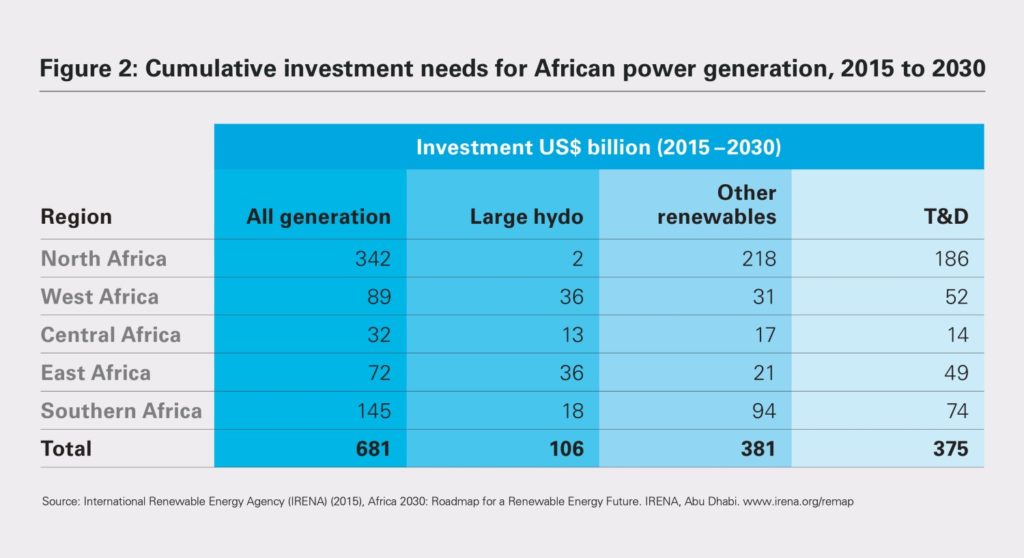

Sub-Saharan Africa has enormous potential concerning renewable energy projects, particularly solar due to the high levels of irradiation. Nigeria is often termed the focal point of west Africa and indeed Africa’s largest economy.

For us, Nigeria was the obvious choice to use as a base. The high level of irradiation and vibrancy of the economy presents numerous opportunities to implement our strategy of commercial and industrial and utility-scale solar. There is enormous potential to implement these strategies in Nigeria. However, all over Africa, there is potential as governments take increasing notice of the role that renewable energy can have in reducing the electricity and power generation deficit.

We want to be the point of a call for these projects as we are already initiating a series of projects across Namibia, Botswana, Zimbabwe, Morocco, Egypt, South Africa, Ghana, Cameroon. We also have operational projects in Mali.

We are heavily vested in supporting the power generation of the continent and welcome parties and companies that are keen on exploring these opportunities with us more carefully in terms of co-investment or projects.

About Zenith Guild Group

Fope Oluleye has been an entrepreneur and business owner since the age of 21 and he started his first business while at university studying business. He describes himself as a Londoner with a globalized view of doing business. He often collaborates with companies and individuals across the world. Oluleye has built and invested in several companies both in the UK, Nigeria, and the US over the past 10 years.

The renewable energy division of Zenith Guild Group started in 2015 when Oluleye recognized the increased transition from power generation to more renewable means. This was heightened with the increased emphasis on the global agenda of a net-zero agenda pledged by governments and countries. Starting with Nigeria, Zenith has focused on increasing energy provision through renewable energy. Starting with the 30 MW project they are initiating and exploring a number of other projects across C&I, utility, and distributed grid systems. Their partnership with PASH Global was deliberately founded to increase their capabilities and to grow both their operational platform and build a larger portfolio of projects under their belt to 1GW by end of 2022.