Written by Elisa Koek

Individual venture capitalists receive over 1000 investment proposals a year from entrepreneurs looking for capital. Although start-ups and small businesses are incubators for growth and innovation, it can be hard to decide which are worth investing in.

SMEs comprise over 99% of firms with paid employees according to Verizon. Yet, 90% of start-ups fail within the first five years. To make a well-consider decision on what to venture into, we will discuss industries and examples with great potential in this article.

Angus McCurdie, Head of Strategy at Zenith Guild Group, recognizes four trends in venture capital that will probably remain over the course of this year:

- Venture Capital Sustainability (Green Venture Capital)

- Cryptocurrency & Banking

- Hospitality & Customer Service

- Healthy Lifestyle & Health Consciousness

McCurdie has a background in corporate strategy and M&A with Citco. He is also a successful entrepreneur, resulting in a bird’s view of the Venture Capital world.

1. Venture Capital: Sustainability

While sustainability has been an upcoming trend for years, the pandemic has increased the awareness of it in our environment. A reduction in human activity gave people the chance to recover and the opportunity to occupy new spaces and niches. Our home, health, and future were on edge. It is only logical that our perspective on sustainability has shifted to a higher priority.

“We can see Venture Capital Firms moving the sustainability sector in multiple ways”, McCurdie elaborates. “It is improving and diversifying the possibilities of the market resulting in more advanced products and technologies.”

Software to manage the stability of energy resources

As the demand for sustainable energy rises, the hurdles of maintaining strength in national grids grow too. Especially in emerging markets, issues of curtailment are prevalent, but this gap can be bridged by new software like the award-winning technology of Elexsys.

Corporations can reduce energy bills by 20-30%

McCurdie explains that Elexsys has reduced corporations’ energy bills by 20-30% whilst maximizing the economic returns of renewable assets. “Having attained 250+ clients and revenues of $12.9m in 2020, Elexsys has a track record of complementing renewable solutions by managing the stability and resilience of distributed energy resources, both on & off-grid”, McCurdie points out.

This software can solve issues for developers and institutions alike who are pledging net-zero emissions in the years to follow. The niche in sustainable development has great potential and could be a profitable form of venture capital sustainability with impact.

2. Cryptocurrency & Banking

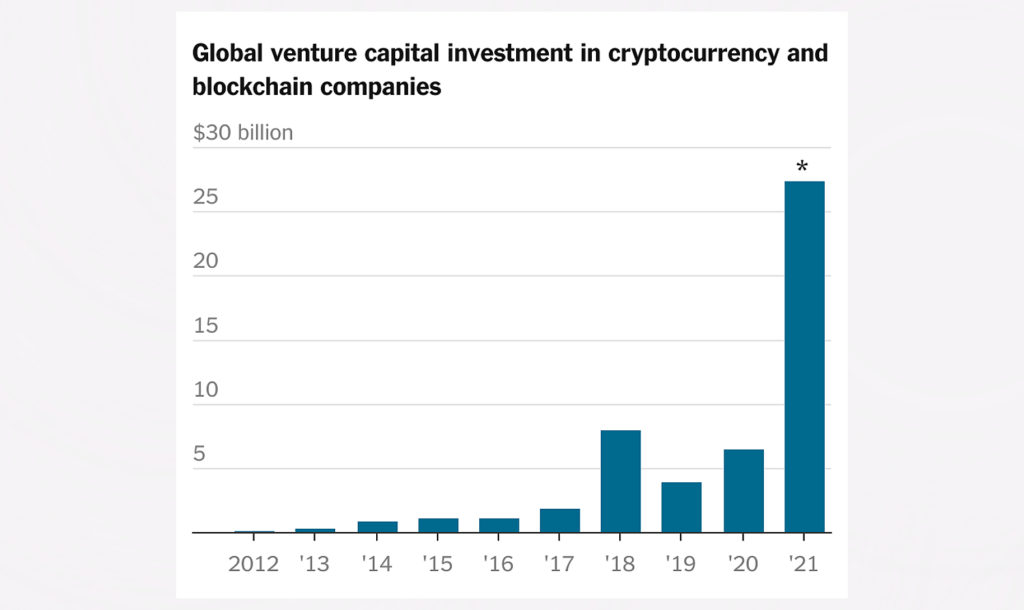

Venture capital firms invested $33bn into crypto startups in 2021, more than all previous years combined. Crypto start-ups accounted for 5% of the total venture capital and the valuations in the last quarter of 2021 were 141% higher than other industries in the venture capital arena.

Stats taken from November 2021 – Source: Pitchbook / The New York Times.

Some experts say crypto could even be the new gold: literally, as tech entrepreneur Tyler Winklevoss stated that the thesis for bitcoin is better than for the yellow bricks.

“Crypto has been favored by turbulent venture capital markets for years and the recent developments in Ukraine and Russia seem to confirm this”, McCurdie states. Donations for Ukraine in crypto coins rose to $100 million while Russians have been able to bypass their local financial system by using cryptocurrencies. The increasing interest in cryptocurrencies is set to continue.

Challenger banks

In addition to crypto, alternative banking is gaining traction. “The so-called challenger banks have increased massively during the last three years”, McCurdie explains. Between 2019 and 2020 members of US-based challenger banks increased by 40% resulting in 39 million users. Challenger banks are banks that focus on digital banking, cryptocurrencies, or niche banking, like Fintech banks that combine financial services with innovative technology.

Banking apps

Responding to rapid-paced development in the financial world, the rise of new software and technologies is inevitable. “Ziglu is an example of an innovative banking app that allows you to buy or sell crypto with great exchange rates in an easy and fast way”, McCurdie explains. “The company aims for financial inclusion by providing easy access to crypto for everyone giving the company an extra asset when it comes to impact investing.”

3. Hospitality & Customer Service

The impact of the pandemic on the hospitality industry has been experienced on a global scale. To reopen many governments made contact-free service mandatory allowing customers to utilize restaurants, bars, or hotels, but without physical contact. It is exactly this development that led to new interesting technology in Hospitality & Customer Service.

AI technology as a long-term solution

“Effortless and contactless technology can bridge the gap between customer animosities post covid, and the strong revenues the hospitality industry once saw”, McCurdie says. This long-term solution suits sustainable venture capital by introducing a safe long-term solution for hospitality to operate.

McCurdie refers to Billa AI technology as the perfect innovation for this pressing issue. ”Billa’s technology and the integrated visual system allow a unique contactless experience; customers can order and visualize their meal through AR without the need for waiters or menus, whilst being able to pay for the bill straight away.”

4. Healthy lifestyle and consciousness

Coronavirus significantly increased the scrutiny towards our health and this impacted health-conscious consumers. $5.4 billion in venture capital funds were invested in digital-healthcare companies in the first months of the pandemic. Research by McKinsey showed that 37% of their respondents agree or strongly agree that the virus motivated them to change their diet to be healthier.

Transparency of health data has boomed

The trend towards more data-driven health innovation has been increasing for years, according to McCurdie. “Transparency of health data has boomed over recent years, from smartwatches to the rise in plant-based products. People want to see and know the results of their healthy lifestyle: they want proof that their effort is actually working and also that what they consume is aligned to their wider values i.e. sustainability etc..”

Data-driven health technology

McCurdie sees a lot of potential in tools that support a data-driven approach. He launched his own start-up, Happy Joe, with which he is at the forefront of this health-conscious consumer trend. The company combines nutritional science with the everyday consumer and makes it easy, accessible, and affordable to maintain a healthy lifestyle.

Happy Joe is purely data-driven and objectively promotes meals based on their health benefit rather than the cuisine. The recommendations are based on the meal’s data profile. “We believe the data play around health is going to grow. The demand for further transparency and platforms that aid healthy eating is going to be the future and create a great opportunity for sustainable venture capital.”

Read more about: Investment Opportunities