Investing abroad can lead to great ROI, however, foreign rules and regulations can be complex and time-consuming to get familiar with. In this guide, we will address the many aspects of investing in the UK, the United Kingdom.

Investing in UK property

The UK presents attractive statistics on property investment. According to Seven Capital, UK house prices have risen at their fastest rate in the past seven years, increasing by 10.9% compared to this time last year.

It is important to do ample research before deciding on where to invest. Across the 51 cities in the UK, there are a plethora of ways to invest in the UK market.

The first and most common thing that people look for is rental yields. The rental yield is an annual percentage calculated by the average cost of rent or the value of the property. Ideally, if you’re looking for a higher rental income, you want a higher rental yield. Currently, the best UK rental yields in 2022 are in Nottingham, Manchester, Bradford, and Newcastle, which show returns of 9.80% to 11.30%.

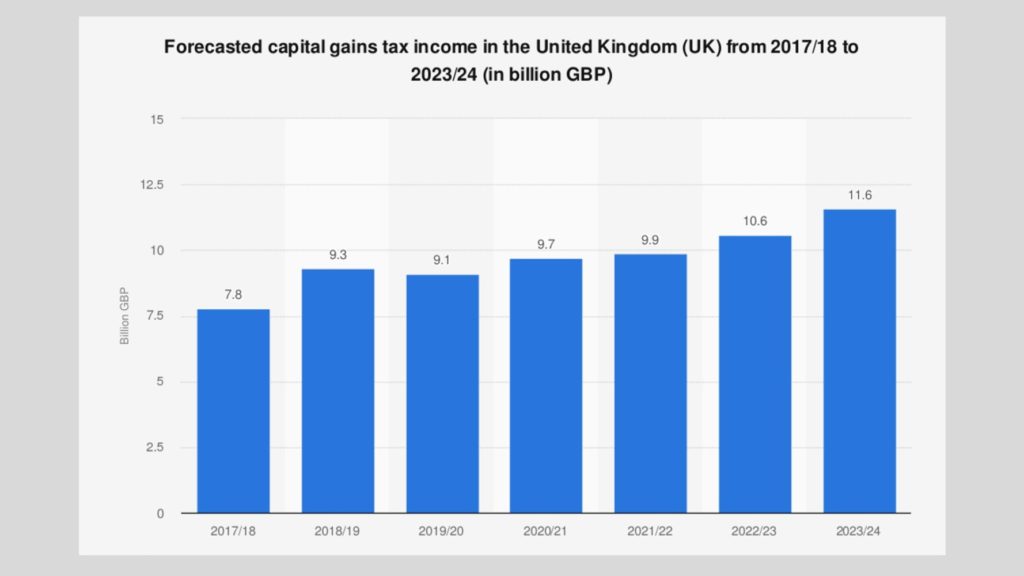

Account for annual capital gain

Owning a sustainable investment property means you have to account for long-term capital growth. The best area for capital growth in 2022 is Middlesbrough, Liverpool, and Preston.

These cities are projected to grow 18.8% by 2026 while offering high capital gains over the last 12 months, with prices rising between 12-20%.

Rental Demand, Affordability, and Future Regeneration

Although rental yields and capital gain are a good place to start your research, these are just city averages. When you’re investing in a property, you’re not investing in the city average, but rather a unique location and property. In your analysis, consider things like amenities, transportation, population growth, and the physical attractiveness of the property. These will all contribute to factors such as rental demand, affordability, and future regeneration.

According to Seven Capital, these are some of the top areas to invest in the UK market (for real estate) in 2022 considering various factors.

Birmingham:

Birmingham is named one of the top places to invest in 2022, followed by its streak from 2016. It’s an attractive area due to its higher average income relative to its living costs. This attracts skilled talent pools because people can afford to spend more of their income.

According to Savil, Birmingham is on track to become one of the fastest-growing regions over the next 5 years, with a predicted growth of 24%.

Average rent prices are promising, given their rise by 30% over the past decade and expected 12% growth over the next five years. Tenant demand is boosted by young professionals leaving London for more affordable housing options. The population is set to hit 1.24 million by 2030.

New transportation links will drastically improve mobility with the Midlands metro expansion as well as the HS2.

Manchester:

In the recent five years, the northern city of Manchester has trailblazed the growth, boasting some of the greatest capital gains. Savil forecasts property prices to rise by 28%.

The employment growth is particularly notable, with 84% added between 2002 to 2015. It’s become one of the top living destinations for young professionals.

In regards to transportation, the Great North Rail Project is expected to come into effect by 2022 and will allow 40,000 passengers to travel throughout the key cities in the north. This is set to increase tourism significantly.

Nottingham:

Nottingham is known to be more affordable than any other city as well as having attractive yield nodes of 9%. Despite yield nodes slowing down to 4.92% due to the pandemic, a major strength of Nottingham is the capital growth and long-term yield growth.

There is an ongoing major tenant demand driven by the two universities situated near the city center. Nottingham is also home to a super hospital, Queens Medical Center.

New Castle:

New Castle is known for its attractive rental yields in the heart of the city (6-7%) and is home to a growing number of startups. Because of its affordability and high-skill labor market, the rental demand is higher than in most cities.

There is a stronghold of corporate headquarters, as well as educational and digital sectors which engineers ample career opportunities and improves graduate retention.

Read more about Real Estate opportunities

Investing in UK business

There are significant business investment opportunities in the UK. At a 19% corporate tax rate, the UK has one of the lowest in the G20. There’s also no withholding tax on dividends paid by UK companies to shareholders in another country.

The UK offers a number of attractive venture capital schemes to help small and medium businesses expand. The two primary ones are the Enterprise Investment Scheme and Venture Capital Trusts which offers tax relief for individuals interested in investing in UK small businesses.

Enterprise Investment Scheme (EIS)

Enterprise investment schemes (EIS) offer tax relief to individual investors who buy new shares in your company. You’re allowed to raise up to £5 million each year and a max of £12 million in your company’s lifetime; this number is inclusive of all amounts received from other VC schemes. In order to qualify for tax relief, the company must receive an investment backed by a VC within 7 years of its first commercial sale.

The money raised by a new share can be used for:

- A qualifying trade

- Preparing to carry out a qualifying trade, which must start within two years of investment.

- R&D that’s expected to lead to qualifying trade money must be used within 2 years and can’t be used to buy parts or all of another business

Venture Capital Trusts

The Venture Capital Trust Scheme encourages individuals to invest indirectly in a range of higher-risk trading companies through a VCT. There is no corporate tax on capital gains and income tax relief of up to 30% for investments over £200,000. Qualifying companies can raise up to £5 million in any 12-month period from VCT investment, or £10 million for knowledge-intensive companies.

Research and Development Tax Relief

Generous incentives exist for companies invested in Research and Development (R&D) in the UK to promote fast-growing innovative services and products, such as the R&D Expenditure Tax Credit.

Small Medium Enterprises (SMEs) are privy to an additional deduction of 130% of their qualifying costs from their yearly profit, on top of the normal 100%, making a total of 230%.

Even if the company is at a loss, it can still claim a tax credit, worth up to 14.5% of the surrenderable loss.

Patent Box offers a 10% corporation tax (compared to the usual 19%) on profits from patented inventions in the UK.

The Vibrant Talent and Labor Force in the UK

According to the Global Talent Competitiveness Index 2018, the UK is one of the top European economies for attracting and retaining talent. The UK places third in the world for attracting global talent. It ranks second in the world for the quality of universities, with four of the top 10 universities located in the UK: Oxford, Cambridge, Imperial College London, and University College London. You may not know that the UK is native to 78 Nobel Prize winners which is more than any other country besides the United States.

Ranking third in the world for the pool of knowledge skills, the employment rates in the UK rise above the European average of 68.5%, at 75%. They also have relatively lower labor costs compared to Italy, France, and Germany. The UK is the only labor force projected to expand over the next 15 years, unlike other European countries like France, Spain, and Germany which are all expected to contract.

One of the five tenants of the UK Industrial Strategy involves a strategy to aid businesses in creating more employment opportunities. This includes covering the costs of apprenticeships. The UK is particularly specific about developing a high-skill labor force, as well as supporting entrepreneurship. It created the Global Entrepreneur Programme to encourage ambitious and internationally mobile founders to scale their businesses from a UK HQ.

A Guide to Investing in Stocks for Beginners

People that desire to make small investments in the UK, might look towards the stock market as a way to invest their excess income. The objective is to have their capital appreciated over time and earn passive returns. The stock market goes through regular ebb and flows, therefore, it’s important for an individual to analyze their risk tolerance and evaluate the time they’re willing to invest.

A good gauge to determine whether someone is fit to invest is if they can afford to hold their investments for 5 years or more. It’s recommended if an individual foresees themselves needing this money before then, that they would be better off keeping it in cash.

There are different levels of risk when it comes to investing. Picking individual stocks might be riskier, but if you pick the ones that appreciate drastically then you will be subject to greater returns than if you diversified your investment among a number of average-performing stocks.

To summarize before you decide to invest:

- Analyze your risk tolerance

- Ask yourself how long you’re willing to have your money invested for

Here are some tips to get you started

Open a low-fee investment account

There are a variety of channels you can open an investment account. Banks generally have advisors that can help you open an investment account depending on your needs. Opening an ISA or investing in a pension might be a good option if you want to avoid tax on your capital gains.

Another way is to sign up for a low-fee investment account on a trusted platform. Nutmeg, Evestor and Vanguard are some examples. These days you can take advantage of Robo Advisors that assesses your goals and select diversified portfolios based on your profile. This is useful for individuals who want to make small investments in the UK, and want full control over their portfolio, but not recommended so much for beginners.

The limitations of bots pertain to risk management and emotional regulation. Unlike certified portfolio managers, bots don’t manage the risk of the stocks they pick. Also, bots cannot hold your hand if the market goes down. Bots can’t analyze the overvaluation of a company nor perform investigations of companies on fraud or exaggerated balance sheets.

If you’re looking to invest in the UK market and want to start by making small investments in the UK, you might want to engage with an accredited financial advisor to help you liaise with multiple types of investment funds. These funds are generally actively invested by professional portfolio managers. Advisors offer a variety of portfolio options ranging from pensions and life insurance to index funds and mutual funds. This is beneficial if you want someone you can seek investment advice from, and to help reallocate your investments when needed.

The advantage of having access to portfolio managers is that they perform due diligence on the companies they invest in. This means a thorough investigation of whether a stock price is under or overvalued. They analyze balance sheets, meet with the management team of the companies they purchase from, and look out for fraud or other internal conditions within the country to predict whether it will lead to the downfall of stock in the near future.

Be aware of trading fees and commission payouts

When you trade stocks individually, you may be subject to a fee per trade. The following online brokers: Fidelity, TD Ameritrade, Interactive Brokers, and Charles Schwab, require no minimum investment, and $0 for stock/ETF trades, $0 plus $0.65/contract for an options trade.

Consider dollar-cost averaging

Instead of investing a lump sum: set up smaller automatic deposits to an investment account to help counter fluctuations in the market. Using this strategy implements a mechanical vs emotional tactic for investing, and will lower your risk of being impacted by large market shifts because you’re investing regardless of whether the market goes up or down.

Invest for the long-term

Taking money out of your investment account undermines the overall purpose of investing. The best way to guarantee a healthy average return is to invest for the long term. Therefore, keep mechanisms in place that prevent you from taking out money from your investments. You can set up an account that penalizes you for taking money out before the term is ended.

Sign up for a high yield savings account, which will generate more return on average than regular savings account in exchange for a longer lock-in period.

Take advantage of your employer’s pension scheme. They will automatically deduct some money from every paycheck, match it and invest it in a pension fund for you.

Investing in ISA stocks and shares will yield greater interest than a cash ISA, plus the growth you get from ISA gains is free from capital tax.

Types of Stocks

Shares

Shares are what you can buy if you want to invest in the success of a company. In theory, if the company you bet on doing well does well, you get a little piece of its profits. The way you would earn profits is by selling some of your shares. Another method is dividend investing in which the company is obligated to pay you out a set amount if the company has profitable margins.

The 100 biggest companies in the UK are listed on an index called the FTSE 100.

ETFs

If you like to make smaller investments over a more diversified stock portfolio, ETFs are a good way to go. You can invest in thousands of stocks, commodities, bonds, or a mixture of investment types. and cash your position at any time. ETFs are publicly traded and an example is the Vanguard Total Stock Market ETF.

There are two potential revenue streams you can gather from ETFs. One is if the collective value of the stocks in the ETF rises, so will the value of your investments. The second option is if your portfolio holds dividend-paying stocks or bonds, you will receive your share every quarter (three months).

Index Funds

Index funds track a collection of stocks from an exchange or an economy. For example, the FTSE 100 is the UK’s primary index that tracks the largest 100 companies listed on the London Stock Exchange. The Dow Jones and S&P 500 are two of the most renowned index funds which track the largest and stronger companies in the United States.

The S&P has averaged annual returns of 10% since its inception in 1926. Historically, it has gone through many bear markets and recessions but has always recovered.

Bonds

When you buy a bond, it means you’re lending money to either a company or generally, the government. These are considered low-risk, but low-yield investments. You receive set payments at the end of the period when the bond matures, as well as regular interest payments as coupons.

Funds

You can choose to diversify your investment by investing in a group of shares. That way when one company in the portfolio performs badly, the other companies can help mitigate the risk.

There’s an option to invest in active funds (managed by professional money managers) or passive funds (those that track the stock market).

Property

If you’re interested in investing in several property projects as a way to invest in the UK market, there’s the option to buy into an investment trust where managers will select a number of properties.

Precious Metals

Another investment option is precious metals. Precious metal prices are less prone to price fluctuations and are often used to protect against turbulence in the market or to fight inflation. There are investment funds that specialize in precious metals by Wells Fargo, Fidelity, Gabelli Funds, USAA Investments, and Invesco.

FAQs:

Investing in UK Property

Are the best places to invest in the UK prone to change?

Lists that promote the best places to invest in the UK take into account a number of factors. Measurements like rental yields and capital growth are only an average. Forecasts are estimates of what could happen in this particular market in the span of a few years. However, more stable attributes to look at are tenant demand in relation to what’s around the property ie. schools, commercial spaces, amenities, and transportation links.

You also have to assess whether your goals are about earning more rental income in the short term or long-term appreciation of the property itself. Keeping this in mind, “the best places” are prone to change, but ideally, you want to look for property in a region that covers a variety of advantages, rather than just one.

Business

What are the impacts of Brexit on foreign investments in the UK?

According to a report by the London School of Economics, the UK has an FDI stock of over £1 trillion, of which about half is accounted for by members of the European Union (EU). FDI raises national productivity, output, and wages. Part of the UK’s attractiveness for FDI is its connection to a single EU market which means following Brexit, increased trade costs would likely depress UK’S FDI.

How do I qualify for R&D Relief?

To qualify for R&D Relief, you need to explain the following:

- looked for an advance in science and technology

- had to overcome uncertainty

- tried to overcome this uncertainty

- could not be easily worked out by a professional in the field

Stocks

How do I hedge against risk when investing in the UK market?

There are always associated risks with investing in the stock market. The best way to hedge against risk is to diversify your portfolio, to not only include different shares of companies across many different industries (like finance, energy, tech, climate..etc) but also include other investments like real estate, cryptocurrency, and even startup businesses into your portfolio. For beginners, you would start by investing a small amount distributed across your portfolios for more even returns.

Be wary that taking less risk means you’re opting for a lower return rate compared to if you took an aggressive investing approach.

Conclusion

There’s a vast variety of ways one can invest in the UK. Always do your research or consult an expert whether you’re thinking of investing in the real estate market, stocks, or starting a business. Among the greatest advantages of investing in the UK are the diverse and growing population, quality of life, the skilled labor force, and generous tax relief schemes. As a beginner, you might fare better taking less risk and slowly adding more as you gain more experience in investing across different sectors.