As an independent entrepreneur who has achieved success in a variety of endeavors, Joe Tagliente credits some of his latest success to robotics and digitization.

This article will take about 2 minutes to read

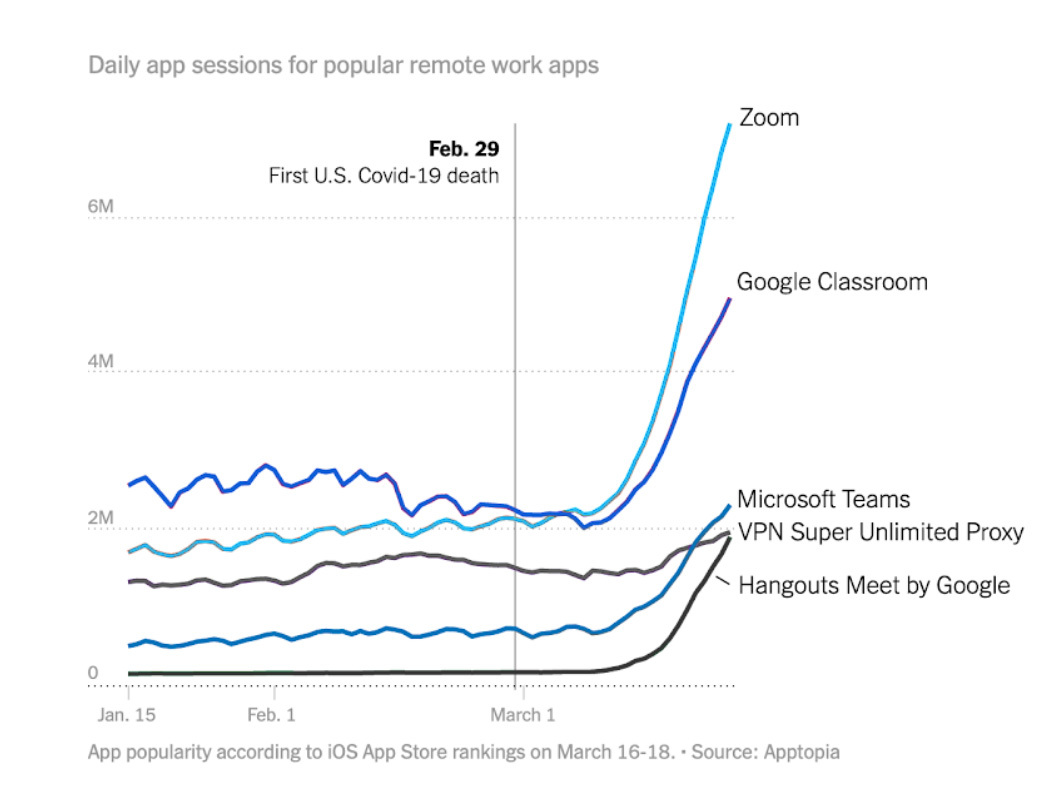

The COVID-19 crisis has been a wake-up call for the world to go digital. “Necessity is the mother of invention” and many businesses have realized the need for digital transformation in order to remain operational, competitive, and profitable. Before the pandemic, only around 30% of companies used remote resources for work. Now, large corporations such as Google have changed tacts to declare 100% remote work through the summer of 2021.

As more and more companies follow suit, online communication networks and business platforms are emerging as integral parts of day-to-day business operations. Only six months ago, many executives would have frowned at the idea of conducting important meetings through video chat. Now, these platforms and practices are becoming not only acceptable but even popular in the corporate world. 70% of executives around the world have identified the necessity of digital transformation and plan to use online instruments indefinitely. “Digital entrepreneurs” are the entrepreneurs who are learning to adapt now to have an edge in the technologically revolutionized future.

Robotics, Revenue, & Raises

One of these digital entrepreneurs capitalizing on innovation is YPO and Opportunity Network member Joe Tagliente.

Tagliente is partner and CEO of the Lenrock Management Group, LP, a real estate investment advisory firm, and Managing Partner of Tage Capital Partners, a private real estate investment trust. It’s safe to say that Tagliente has substantial and varied investment experience.

While attending an event at Cornell, Tagliente was asked to share some of that experience with students in the form of a guest lecture. Following the event, Tagliente was discussing the presentation with several students who had attended. One student, Micah Green, told Tagliente about a robotics company he was working on with a few friends. He called it Maidbot. The company, he explained, would be able to deploy high-tech bots (maidbots) to clean hotels.

Having worked in hotel operations for many years, Tagliente recognized the potential in the project right away. However, at that point, the bot was still a prototype so he told Green to contact him if he ever needed help or advice.

Six months later, Tagliente received a call. On the cusp of finalizing their technology but out of funding, Maidbot’s team of four Cornell engineering students and two NASA engineers needed capital quickly. Having invested in the company himself, Tagliente wanted to reach out to a wider network of global investors. And that’s when he turned to Opportunity Network.

Venture Capital Reimagined

In today’s market, raising venture capital can prove rather difficult. Stiff competition for limited financing means that many entrepreneurs are left empty-handed. Even with a great pitch and impressive metrics, it can be difficult to get investors on board. Raising money organically takes time.

A study by the Harvard Business Review demonstrated that, in emerging companies, managers commonly devote as much as half of their time to raising outside capital and getting investor attention. Furthermore, traditional venture capital is costly. Fees to lawyers, underwriters, and accountants coupled with the price of going public means losing as much as 35% of hard-earned capital.

Having experienced these hazards himself, Tagliente knew that it would be more efficient and less costly to go digital. In two posts on the platform, Tagliente closed $300,000 of seed capital for Maidbot.

With funding behind them, Maidbot has gone on to win 28 awards and be named one of America’s top 30 emerging companies by Inc.com.

“I’ve had a very good response to Opportunity Network. Digitalization has opened up my startup to more investor eyeballs than I ever could have gained through in-person networking alone. It’s helped me gain a lot of traction.” – Joe Tagliente

The Future of Maidbot and Robotics

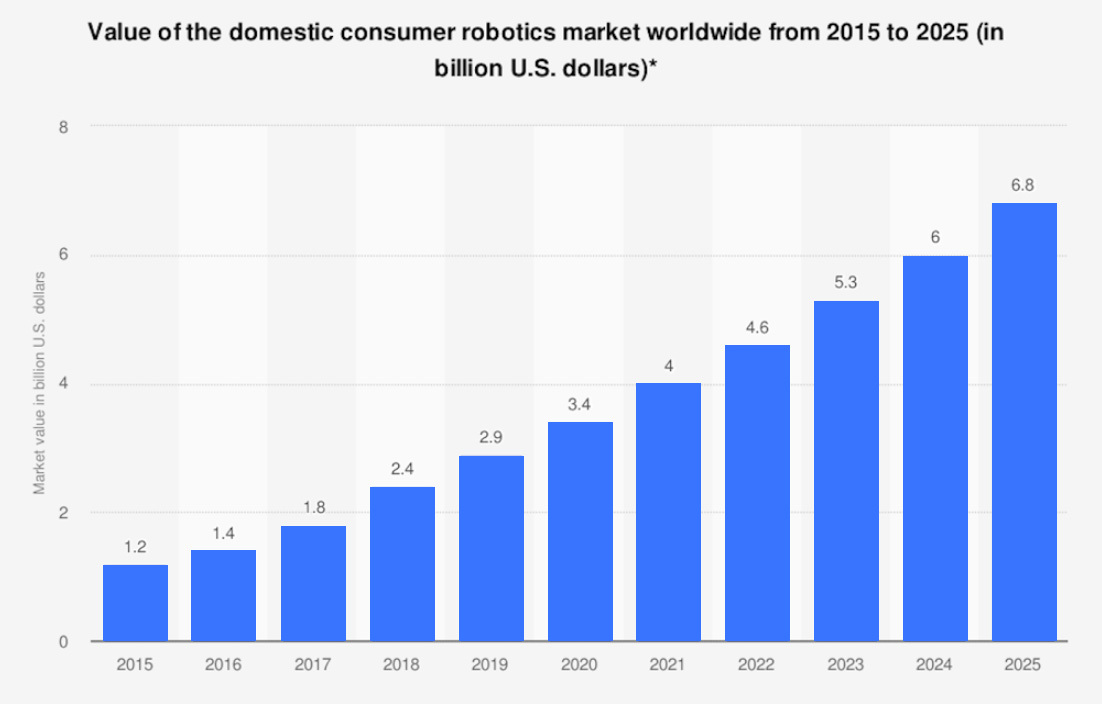

Along with digital communication, mass innovation in AI and robotics is happening now. The global robotics market is expected to grow at a CAGR of 26%, reaching an industry value of $210 billion by 2025.

In the global battle against COVID-19, one of the technologies making enormous impacts on the ground is robotics. Hospitals are using robots to aid healthcare staff and patients. Robots are being deployed for disinfection, food and medication delivery, and measuring vital signs. In circumstances involving sanitation, robots fill a huge gap because they can perform routine disinfection tasks without transmitting diseases and germs. With a growing concern for public health, Maidbot is positioned nicely to own a large share of the hospitality market by offering a safe and cost-effective alternative to human cleaning services.

Out With the Old, In With the New

While the past certainly continues to instruct and guide us, time and circumstance have revealed new ways to conduct business more efficiently. For Tagliente, digital fundraising was not only more time-efficient, but also more cost-effective to the venture capital he would have procured through conventional procedures. Putting digital networking tools, like Opportunity Network, in the hands of skilled entrepreneurs could be the ticket to rebuilding a crippled post-pandemic economy.

Joe Tagliente

Partner & CEO at Lenrock Management Group, LP