A year ago, the global legal cannabis market was valued at USD 17.5 billion. In 2027, the market value is predicted to reach a staggering USD 65.1 billion. 3 CEOs explain why the opportunity for investment is huge and how to securely maximize profit.

The global cannabis industry is currently expanding at a compound annual growth rate of approximately 17.8%; 6.3% higher than that of the entire organic food and beverage industry. In 2017 alone, legal cannabis sales in the U.S. reached higher than the combined sales of Oreos and organic produce. Meanwhile, between 2013 and 2016, the number of cannabis users in the U.S. nearly doubled.

North America isn’t the only country to experience overwhelming growth within the cannabis industry either. A 2018 Forbes article predicted Australia’s legal cannabis market value to grow from $52 million to $1.2 billion between 2018 and 2027. While in Europe, the increasing demand for cannabis has been driving the price per gram higher and higher.

According to a 2019 EU Drug Markets Report, cannabis is the most widely consumed illicit drug in Europe, with an estimated minimum value of EUR 11.6 billion. This figure is expected to increase rapidly as legislation becomes relaxed and cannabis becomes accepted in societies as a medicine rather than an illegal drug. In fact, the European cannabis market is expected to expand from US$ 3,498.1 million in 2019 to US$ 36,997.1 million by 2027. More specifically, it is anticipated to grow at an overwhelming CAGR of 29.6% from 2020 to 2027.

We spoke to Opportunity Network members, Justin Singer, CEO of Caliper Holdings, Smoke Wallin, CEO of Vertical Wellness, and Eric Spitz, CEO of C4 Distro, to find out how industry experts envision the future of cannabis, specifically as an investment opportunity.

Global Cannabis Legalization

Before getting started, let’s have a look at the current state of the cannabis industry and how we got to this point.

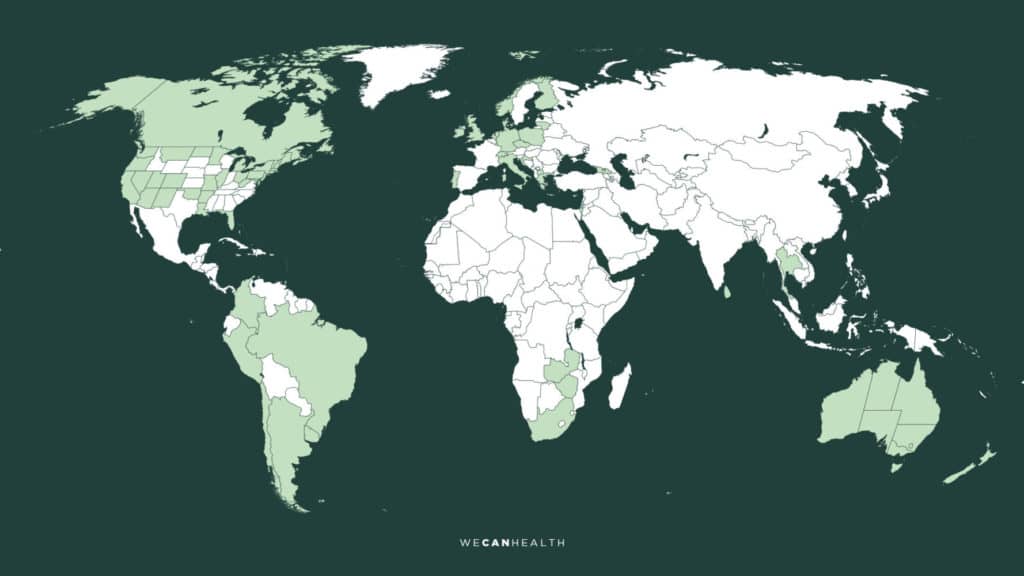

Today in 2021, the medical use of cannabis is legal in 42 countries. Recreational use is currently legal in 15 US states, Uruguay, Canada, South Africa, and the Australian Capital Territory in Australia. Legalization isn’t stopping there either. More states and countries are anticipated to restructure legislation and advance cannabis legalization actions in the years to come.

According to Precedence Research, in February 2019, Thailand became the first country in Southeast Asia to allow the consumption and growth of medical marijuana. This resulted in the opening of its first legal cannabis greenhouse.

In Europe, since the 1970s, “coffeeshops” started to appear across The Netherlands, where consumers can buy and consume cannabis on-site. In 2017, Germany passed a law legalizing the medical use of cannabis which led to the initiation of several research studies across Europe. And in 2018, the UK followed suit, legalizing the medicinal use of cannabis and receiving an overwhelming amount of public support.

In fact, groups of users in a number of European countries, including Spain and Austria, have also formed cannabis social clubs which are fully registered under the law. Belgium and Luxembourg have decriminalized the personal use of cannabis. And from 2017 onwards, low-THC herbal cannabis and CBD oil have been offered for open sale in health food shops or specialist shops across several EU countries.

When asked whether the cannabis industry is likely to expand on a global scale, Justin Singer, CEO of Caliper Holdings, answered, “of course it will expand globally. Cannabinoids, especially THC and CBD, meet universal needs for relaxation, escape, and relief. The question isn’t whether there will be demand beyond our borders. The question is how we will reconcile new cannabis policy with existing cannabis policy given how much of existing policy has been woven into international treaties over the past forty years.”

CBD Product Market Expansion

CBD stands for cannabidiol. It’s the second most prevalent of the active ingredients in cannabis and is derived from the hemp plant, a cousin of the marijuana plant.

Demand for CBD has been rising since the UN removed cannabis from its Schedule IV category and European courts no longer deemed CBD as a narcotic. The World Health Organization has publicly reported its health benefits and success in treating anxiety, depression, insomnia as well as conditions such as epilepsy.

With COVID-19 shifting consumer behavior towards a more health-conscious perspective, CBD is becoming an increasingly popular natural remedy. Singer shared with us his professional opinion on the future of the cannabis industry.

“I am extremely bullish on the long-term prospects of cannabinoids as consumer bioactives. Looking out ten years, I see them involved in functional products covering everything from sleep to anxiety to energy to pain to appetite,” he shares.

In 2018, the global CBD market value reached approximately $4.6 billion, increasing to $7.1 billion in the following year. According to leading cannabis researchers, BDS Analytics and Arcview Market Research, CBD sales in the US alone will reach $20 billion in the next 3 years. Similarly, New York investment bank Cowen & Co predicts CBD market value to reach $15 billion by 2025.

Why Invest in the Cannabis Industry?

Smoke Wallin, CEO of Vertical Wellness, invested in the cannabis space after noticing the benefits it had on his veteran friends who suffered from PTSD. “PTSD is a large issue across the veteran community, with up to 22 suicides happening per day. Many turned to cannabis as part of recovery and it was working.”

After building a billion-dollar wine, spirit, and beer distribution business, Wallin raised 65 million dollars to build a cannabis business in California. He explains, “the cannabis space is as big as the beer, wine, and spirits industry in general. However, the bigger opportunity and impact of the plant we’ll have in the long-term is in health and wellness. We’re going to see much more natural and pharmaceutical remedies from this plant in the future.”

Lifelong entrepreneur and CEO of C4 Distro, Eric Spitz agrees, and suggests that investors should “jump in while the water is warm.” Spitz shares, “Cannabis will undoubtedly eat into the market dominance of alcohol as the social lubricant of choice. It is safer, easier to use, and it works instantly with fewer after-effects.”

According to Singer, investing in the cannabis space is a no-brainer. He shares, “Ultimately, cannabinoids can fulfill a promise of supplements, specifically, the promise of low-risk, high-reward bioactives at dose levels designed to deliver modest effects with minimal toxicity risk. That’s a world-changing opportunity deserving of any related company’s or investor’s time and attention.”

Wallin also adds, “Opportunity is massive, and the arbitrage between today when there’s limited institutional capital in the space and sometime tomorrow when capital flows freely into the full cannabis space, is massive.”

Cannabis Investment Strategy Tips

Before making any investment decision, there are several factors to consider in order to minimize risks and maximize profits.

- Take no one at their word

It is vital that investors do their own due diligence. “Fundamentally, cannabis and hemp edibles are food science,” states Singer. “Any company that can’t explain what they’re doing in a way you can understand is probably lying. Investors would do well to remember that things that sound too good to be true probably are and that things that cannot continue will eventually stop.”

Wallin agrees, stating that, “you need to assess every investment in the same way. Make sure people are legitimate, make sure they have a good track record, and make sure they are committed to what they’re doing.”

- Be long-term oriented

According to Singer, “it is important for investors to not get caught up in the fervor of our current speculative mania. Cannabinoids have the potential to be even more impactful than caffeine, but there will be plenty of frustrations and false starts before we reach that point. The hard work of maturing products and orienting markets around evolving regulatory policies will take time.”

- Be aware of and avoid bad actors

In reality, there is enough policy to provide a public perception of oversight, but not enough enforcement to actually drive out bad actors. Singer highlights that as a result, “investors are forced to navigate a classic market for lemons, where low-quality goods and companies tend to drive out high-quality goods and companies.”

- Don’t stay on the sidelines too long

Walin advises investors to be aware that waiting too long can result in missing out on a massive opportunity. He states, “It’s a big opportunity. If you wait until federal prohibition ends, which is likely to happen over the next couple of years, the institutional guys will already be in.”

- Network with trusted people

Wallin highlights how valuable talking to people in the space who you can trust is. According to Wallin, “it’s important to network with trustworthy people within the industry. People involved within Opportunity Network are more than open to discuss opportunities with each other. When raising the money for the cannabis business, we had a number of leads on the platform. Previously, I have posted other deals that have led to investment. And if not investment, definitely introductions to people who can help and we can network with.”