Written by Naomi Peng

Entrepreneurs invest much of their time and energy into building the most innovative businesses. However, in order to scale their ideas, they need access to one important thing: capital funding. What is the best choice: an angel investor or a venture capitalist? In this article, we will address Angel Investors versus Venture Capitalists.

The two traditional sources of start-up funding come from angel investing and venture capital. To ensure that proper financial decisions are being implemented, it is crucial to determine the key differences between angel financing and venture capital. In this guide, we will give an overview that will enable you to make well-considered decisions regarding fundraising for your new business.

Angel Investor versus Venture Capitalist

Both angel investing and venture capital can provide your business with the right funding to execute your plans. However, the investment approaches will differ based on the nature of the companies and their demands.

What are Angel Investors?

Angel investors are affluent individuals who invest their own money into startup funding in exchange for an equity stake. They typically finance the seed and early stages of a company.

The popular ABC show “Shark Tank” features a panel of wealthy judges who hold the checkbook to the contestants’ dreams. These sharks or affluent experts are known to be angel investors. The advice of angel investors is considered to be as valuable to early-stage entrepreneurs as the capital itself. Typically, angels will invest in the industries they are familiar with or have experience in.

An angel partner is often more driven to invest in unique or innovative ideas, whereas venture capitalists focus more on the company’s growth potential.

To gain credibility as an angel investor, it is recommended they apply for accredited investor status with the Security Exchange Commission (SEC). This is a standard that ensures they meet either of the following criteria.

1. Must have annual earnings of more than $200,000 for the past two years

2. Must have a total net worth of $1 million regardless of marriage or tax filing status

What are Venture Capitalists?

Venture capitalists are backed by a risk-capital company where they invest other people’s money into funding companies. These entities include affluent individuals, pension funds, corporations, and foundations. Because these funds are usually comprised of many investors, venture capitalists generally invest larger sums for a greater equity stake in the company. The median deal size for early-stage VC was $4.5 million.

Individuals or entities that want to participate in venture capital funding will generally form a Limited Partnership (LP) structure where specific roles are defined between investors and managing partners. Investors are typically limited partners, whereas management will be general partners of the firm. These investors do not work at the firm but rather, invest in it.

Along with large investment sums, venture capitalists have attractive connections to industry leaders, investors, and helpful third parties.

Differences Angel Investor versus Venture Capitalist

As part of the agreement, venture capitalists typically want operational control of the company. Angel investors are generally happy with taking a passive role in the company they’re invested in.

Angel investors primarily offer financial support and are not obliged to help the company in terms of strategy or operations. On the contrary, venture capitalists are invested in high-potential companies with exceptional management teams. They are not only invested financially but will offer an advisory role to the company’s board and management.

Why is it hard for businesses to gain access to venture capital?

The primary reason is due to unpredictable financial performance. Venture capitalists make decisions based on performance. Seed-stage start-ups often lack a solid financial record, which makes them hard to forecast. This is where angels can step in and take more of a confidence leap for budding start-ups

Angels fill a significant gap in the seed capital market

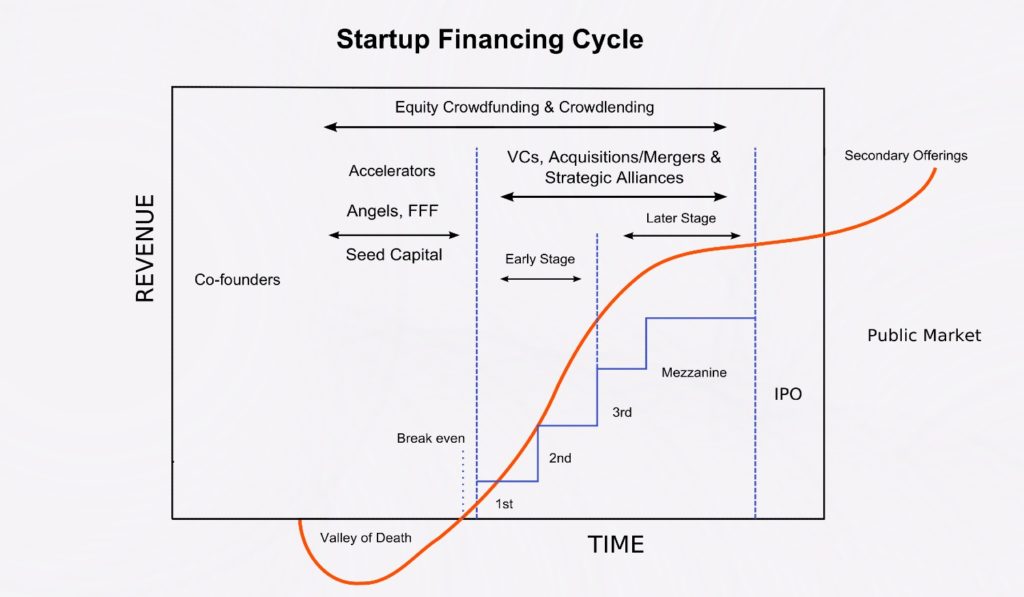

According to a study done by the Center for Venture Research, there is a significant gap between the pre-seed funding stage and the early stage. Therefore, angel investors contribute greatly to this demand for capital in the seed phase.

The funding gap typically occurs between the $100,000 to $2 million range. Prior to the $100,000 mark, entrepreneurs will typically resort to bootstrapping methods to raise funds for their venture. Bootstrapping refers to a variety of means such as personal savings or loans from family and friends to finance their venture without raising equity through traditional sources. As the venture grows, the need for more capital also increases, which most times cannot be readily covered by bootstrapping.

Therefore, businesses looking for upwards of $100,000 but below $2 million may benefit from angel financing. When ventures require more capital in the early stages, they may solicit an angel group. These are comprised of angel investors that regularly pool together their resources to raise capital for a venture.

Venture Capitalists in Early to Later Stage Funding

Venture capital investing is a systemic approach to investing. Typically, when the valuation of a company is above a certain threshold, venture investors are willing to give the company an injection of cash flow for a stake in the company.

The purpose of venture capitalists is to provide rapid growth solutions to a company that has a proven track record. A typical round is between $10 and $15 million. The expectation is that with sufficient capital funding, company X can generate lucrative, above-average returns for the investors, and in some cases raise more equity from initial public offerings (IPOs), further increasing the valuation.

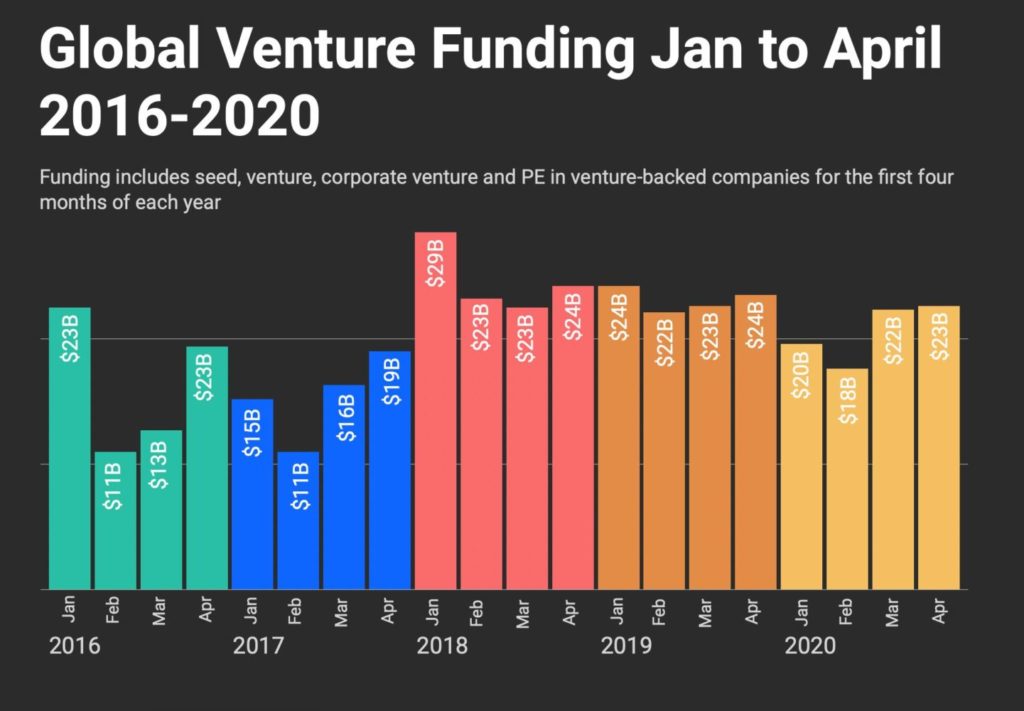

Historically, the period from 1994 to 2000 saw an increase in average deal size, while the number of deals stayed relatively modest. The post-Amazon era was known to produce astronomical valuations for start-ups. Hence, creating a general baseline for venture funds to invest only in larger deals, typically upward of $2 million.

Which is best for your business?

The question of whether to go with angel investing or venture capital comes down to what stage the business is at. Also, the type of business plays a factor in the likeliness it will get funded by VC.

In general, if an entrepreneur only has the ideal proportion of the business established, approaching an angel might be the way to go.

If the business already has a couple of years of proven revenue stream but requires additional funds to grow its infrastructure, then the entrepreneur might consider taking the venture capitalist approach.

Typically, for ventures that require large amounts of capital for implementation, such as software and high-tech companies, venture capital is the most feasible solution.

FAQ

What is a super angel investor?

Super angels share both characteristics of venture capitalists and angel investors. They typically start as angel investors that manage to raise small venture funds. Super angels are known to invest in seed stages, contributing on average $200,000 to $500,000.

In 2020, there were around 300,000 active angels with a total of $25.3 billion invested, making up 40% of total deals.

How much do angel investors invest?

Angel investments mostly start around $15,000 – $20,000 and go up to $250,000. However, the amounts vary a lot, depending on the business needs and relationship with the angel. Significantly low amounts like $5000 are not unusual as well as amounts going up to $500.000 or more.

What is an angel investor vs. venture capital?

Angel investors are individual investors that invest with their own capital while venture capital is backed by a company. Generally, angel investors step in at the early stage of a company while venture capital is used when a company already has a successful track record.

What is an angel group?

An angel group is a group of angel investors that finance a project together. The amounts of funding are often higher than of one individual angel investor.