With the business world picking up the pieces and returning to full function, the time has come to start looking into international expansion across borders. Especially if you are looking to buy, sell or merge. According to Deloitte, over 60% of respondents to a recent survey on The Future of M&A Trends indicate that they have had more of an appetite for M&A activity since before COVID-19 was declared a pandemic.

International M&A opportunities are available all over the world. You just need to know where to look for your business aspirations of global expansion.

There are several avenues to find reliable foreign partners or buyers including trade shows, trade missions, customized services, eCommerce, and other online networks. Opportunity Network is one such network. It makes finding foreign M&A opportunities just as easy as finding them in your own country.

In this the age of information technology, what could have taken weeks or months to gather, can now be yours at the click of a mouse.

As international deals become more accessible, so do their complexity and associated risk. Here are some tips and strategies to help you navigate your search to find lucrative deal-making opportunities.

How COVID-19 Has Impacted Global M&A Activity

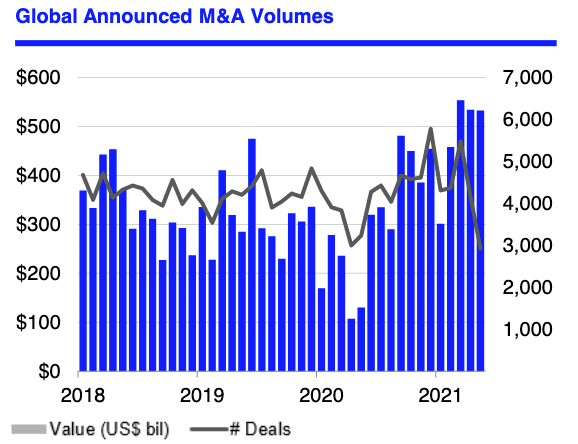

By the end of 2019, the global merger and acquisition market – although a market fraught with uncertainties – was booming. It was the end of a decade that brought the business world some of the largest transactions in history. This was mostly driven by the booming American market (15 out of the 20 biggest M&A deals involved all-US stakeholders), and a wave of “super mega-deals” (each valued at over $10bn).

The COVID-19 pandemic has caused serious shifts and delays in the M&A world and will certainly have effects throughout the market (and the economy as a whole) for some years.

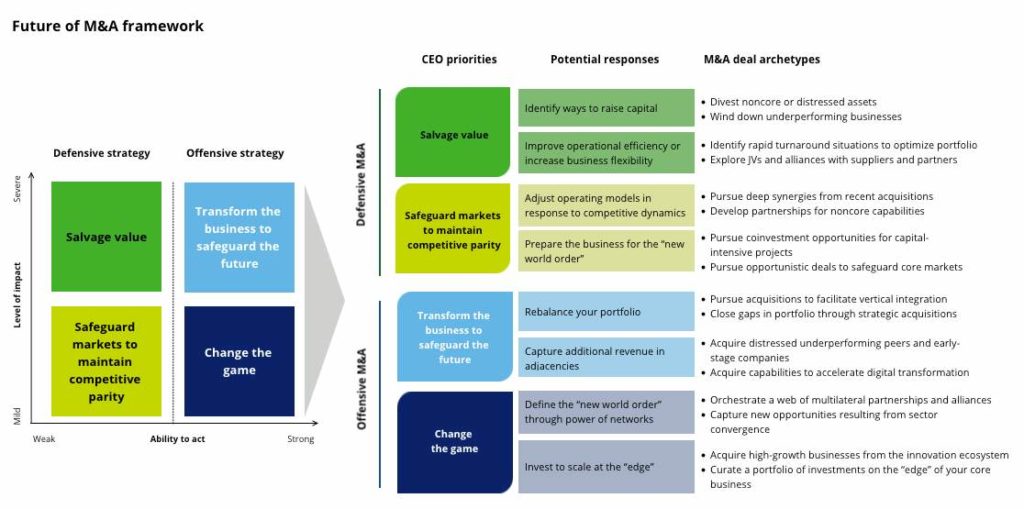

Mark Purowitz, Principal of Deloitte’s M&A Consulting practice said “As businesses prepare for a post–COVID-19 world, including fundamentally reshaped economies and societies, the dealmaking environment will also materially change. Companies were starting to expand their definition of M&A to include partnerships, alliances, joint ventures, and other alternative investments that create intrinsic and long-lasting value. But COVID-19 has accelerated dealmakers’ needs to create more optionality for their organizations’ internal and external ecosystems.”

One-third of surveyed M&A firms are accelerating long-term transformation to other business models

“M&A Trends Survey: The Future of M&A”, Deloitte, October 2020.

American dealmakers have shifted their M&A strategies in response to this post-COVID environment. A Deloitte survey, M&A Trends Survey: The Future of M&A, published in October 2020, concluded that one-third of respondents are accelerating long-term transformation to other business models in response to structural sector disruption.

One-quarter of respondents of the survey (24%) said that they are using M&A and other investment activities to capture unassailable sector and market leadership. The other 43% of respondents are using M&A to stay on par with competition or prevent further weakened positions.

The pandemic has made many business models obsolete, making it difficult to value assets and price deals. Dealmakers have therefore adopted new pricing structures while attempting to mitigate risk and bridge valuation gaps.

In the three years between 2016 and 2019, deal prices were paid in full by completion in 70% to 80% of private transactions recorded. However, in 2020, however, it dropped to 62%. (The balance involved earn-outs or deferred consideration.)

Many analysts are comparing the market to 2008 during the financial crisis. However, with the United States quickly getting back to business as usual, the outlook is positive for a recovery in this sector.

Cross-Border M&A and Top Risks

Before investors expand into the global market, the business must have a solid local foundation. However, in today’s climate, there are many extenuating factors to consider. Seemingly endless waves of COVID-19 trigger lockdowns in countries around the globe while rising unemployment keeps a lid on demand for commodities. This, coupled with international trade tension and regulatory pressure, adds to the uncertainty.

Bear in mind that economic recovery will be uneven across the different sectors and regions when you are dealing with.

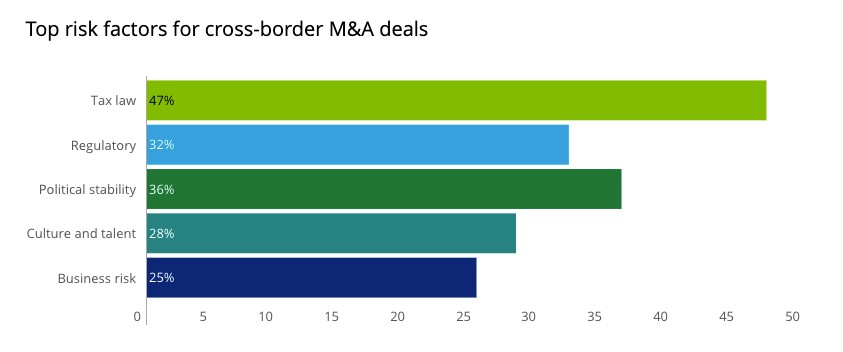

Acquiring companies in international markets have additional risks that potential buyers must take into account. Their perception of risk will have to be revised and their traditional due diligence process will have to be adjusted.

The deal team will need to focus on common risk factors associated with international deals including:

- National and regional tax laws

- The availability, accuracy, and reliability of the target company’s financial information

- The country’s political and infrastructure stability

- The target’s compliance with the US Foreign Corrupt Practices Act, and similar anti-bribery, and anti-money laundering regulations relevant to that market.

To better understand the risks and rewards associated with cross-border deals, Deloitte conducted a survey of over 500 client executives with cross-border M&A experience. The survey concluded 33% of respondents said they regretted not placing enough emphasis on comprehensive planning – both before and after the deal. 31% of the surveyed executives wish they had conducted more research on a target’s market potential and company cultural differences. It is therefore clear that research and due diligence are more important than ever before.

Global M&A and Business Opportunities

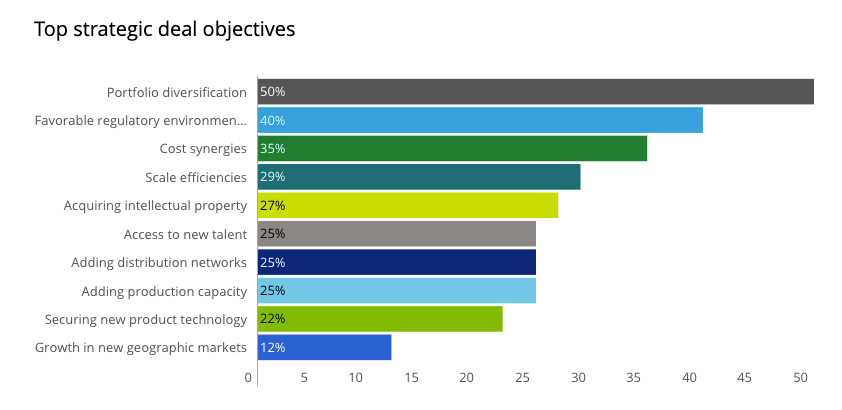

Whether you are looking to grow your business through a merger, acquisition, or organically, here are a number of tips to help in your research and planning in preparation for entering a new market.

- Even if you have the most solid foundation locally, it does not necessarily mean that your business will successfully translate directly into a new market.

It is a good idea to conduct an internal business analysis to help you to quantify the deal. This will help identify your specific resources, capabilities, core competencies, and your unique value proposition. - Some countries are very litigious, meaning that before you can operate in that country, you will have to ensure that all necessary legal documents are in order.

Address the legal matters as soon as possible to protect yourself from legal risks and liabilities. - Consider outsourcing your accounting and bookkeeping functions, build relationships with local banks, and prepare your report sales and VAT taxes.

- Do not let a language barrier or culture gap stand in the way of your success in a new market.

You need to speak the language and break down cultural barriers. This means hiring people who know the market or studying it extensively. - Gather as much information on the local currency as possible and research how it has performed and reacted to external and internal forces over the past decade.

- Staying loyal to your brand is important. However, you might need to adapt your approach to new markets.

Cultural norms and different customer needs could necessitate a change in your marketing, packaging, or product. Some of the most successful global brands have adapted in this way by offering region-specific add-ons to their existing brand’s offering.

Five Common M&A Risks

Forearmed is forewarned! Here are five of the most common risks associated with mergers and acquisitions – including those done in foreign countries:

- The most common risk is that you will end up overpaying for the target company. This will destroy shareholder value. This is a result of poor valuation practice.

- Overestimation of synergies is another dangerous pitfall. Although there might be synergies between the companies, they should be noted realistically and used only as one of many factors affecting the acquisition.

- Poor due diligence practices negatively affect mergers and acquisitions and can lead to poor valuation and increased risks. A good M&A executive will begin diligence timeously, with the right team.

- Poor communication and lack of transparency can destroy a deal. Knowledge is power and when it comes to communication, more is more. Open and honest communication is the only way forward for successful negotiations. In today’s business climate, technology is one of our greatest tools that can be leveraged to ensure the best possible communication and transparency during deals.

- Some risks are unpredictable – unforeseen market disruptions or “acts of God” as they are known. The COVID-19 pandemic is a perfect example of this. Natural disasters can also affect business severely. Even the best people in the business have no way of avoiding these events, following the best M&A business practices can help steer you through them.

Factors That Influence Cross Border Mergers

Years of thorough research have shown that the value of a deal is positively impacted by the gross domestic product (GDP) of the acquirer and target as well as its stock market capitalization. Different languages are not a deal-breaker, but a common language has proven to have a positive impact on the deal value. The stability of law and order in the target country also affects global expansion in a big way.

Interestingly, the research shows that the distance between the acquirer and target country and contiguity does not have a massive impact. However, the deal value is often influenced negatively by the power distance between acquirer target pairs and the so-called masculinity v/s femininity measure index.

How To Sell Your Company To A Foreign Buyer?

International buyers can easily make a cash purchase for a small business of up to $300,000. Foreigners benefit from diversifying their financial assets in the United States and becoming eligible for a U.S. visa (such as the E-2 investor visa).

International buyers prioritize differently when evaluating businesses. Their criteria include visa eligibility, business longevity or stability, and seller training. American business owners need to consider other factors such as E-2 visa purchase contingency, qualifying buyers, projected timeline, and seller financing.

The Ins And Outs Of International Business Negotiation

As business becomes more global, the M&A sector has been forced to adapt and negotiations have become more complex. There are so many new considerations that need to be taken into account:

- Data is showing a recovery in the M&A industry. Can this continue?

- Buyer and seller tactics in the private M&A market have changed dramatically. Is this the new normal?

- Antitrust authorities are frustrating deals. Is this something that you need to be concerned about?

Global transactions almost came to a standstill in the first half of 2020 as the coronavirus swept the planet. Thankfully, we observed a resurgence in the second half of the year, and this is continuing through 2021. We need M&A brokers who understand this volatility.

5 Steps to Find a Reputable M&A Broker

- Use extensive research to eliminate the marketeers. The easiest and first step is to use a local consumer protection agency to help sift out those who have already made a bad name for themselves.

- Ask a trusted business advisor. This sounds like an obvious step, but word-of-mouth reputation is often most reliable in these matters. Your accountant might be a good starting point.

- Contact the firm themselves. Let them pitch you and send their information by explaining their business strategy. Ask for some previous clients of theirs as referees.

- Ask these pertinent questions:

- Does this M&A broker have a strong track record of successful transactions of comparable size to your potential transaction?

- Are their advisors appropriately qualified and experienced?

- Will the project be overseen personally by the advisor? Will this be continued to completion?

- Does the advisor or firm revere client confidentiality and act accordingly?

- Choose consultants who understand your target market. Have they worked in your industry before? Do they understand what your goals are? Trust your gut instincts here too. It is that instinct that has taken you to this point of local success; allow it to help you reach global success too.

Finding the Right Partner for M&A Activities

In the age of technology, with safe, reputable matchmaking networks like Opportunity Network, more business leaders are opting to find M&A opportunities directly. Whether you are looking locally or abroad, M&A opportunities posted directly by vetted business owners and CEOs can be found quickly and easily. Therefore, significantly decreasing the time and cost associated with finding the right deal.

Imagine a safe business environment where you can make connections with over 45,000 leaders in 100+ industries found in more than 130 countries – across Europe, the United States, Canada, and beyond. At Opportunity Network your business gets in front of the right people looking to raise and invest capital, securing new clients, sourcing products and services, and finding M&A and real estate deals. Whether you want to buy, sell, or merge, international opportunities abound. Request your private demo to learn more.