SMEs represent 90% of global business interactions and 40% of the average countries annual GDP. Knowing this, it’s hardly a surprise that SMEs are providing 70% of today’s employment opportunities. But what is surprising? SMEs also represent one of the most under-financed sectors in the global economy.

Small & medium-sized businesses are the backbone of the economy. This has never been more true than it is today. However, as a result of being limited to seeking investment from internal funds or personal sources, SMEs’ growth is often constrained by lack of capital and other resources. In fact, The World Bank estimates that SMEs have an unmet financing need of approximately $5.2 Trillion each year.

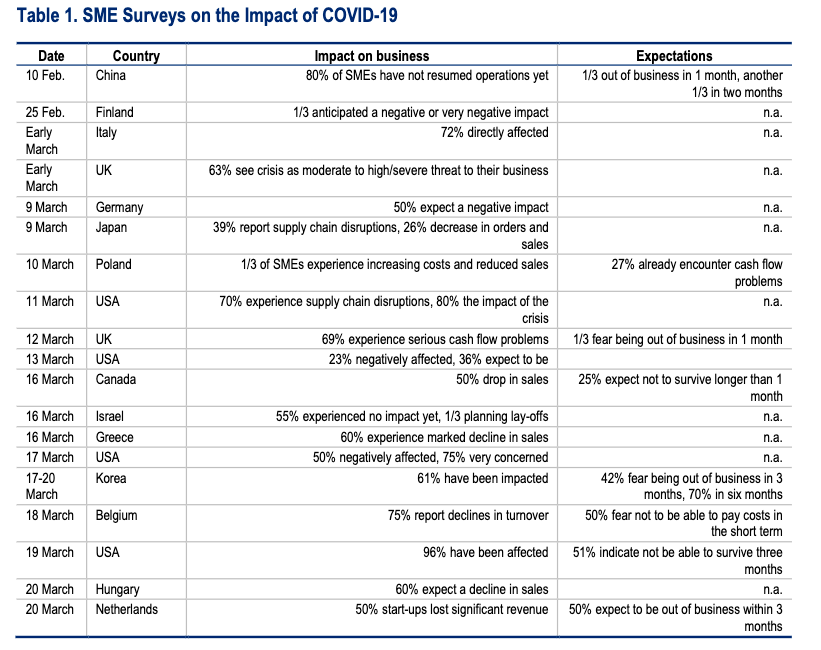

In the short term, the emergence of the COVID-19 pandemic has only exacerbated this problem. Economic turbulence has caused investors to become cautious and global lockdowns have made it difficult for SMEs to make contact or establish relationships with new investors. Banks and traditional financial institutions have also scaled back investment, further increasing this unmet need. Relying on their global networks, most large corporations have been able to withstand these economic shocks. However for smaller businesses, one broken link in a supply chain could spell the end for the entire enterprise.

But within crises, there is always opportunity. While many companies may shut their doors, the ones who are agile and adaptable will emerge from the crisis with few barriers to growth.

As mentioned by McKinsey, “to adapt, companies need to quickly rethink customer journeys and accelerate the development of digital solutions.”

The COVID-19 pandemic has incited what can only be called a digital revolution. From internal communication to deal sourcing, day-to-day business is now being carried out primarily through online tools. Those who may have previously dismissed the need for digital integration are looking for fast solutions, and tech companies are doing their best to provide.

But What Does This Mean for SME Financing?

Opportunity. FinTechs are levelling the playing field across industries and borders. The days of relying on personal resources or traditional financial institutions are over. Digital deal matching platforms, investment apps, and crowdfunding sites have created equal access to global investors. At Opportunity Network, we’ve launched a new tier in our platform, Opportunity Network’s LITE membership, which specifically caters to smaller companies and startups. Our goal is to help these SMEs leverage our global network of over 32,000 CEOs and investors so that their growth is not limited by lack of capital or opportunity.

Fabia Silva, both a member of Opportunity Network and CEO of Dronak, an SME technology company based in Spain, expressed that “entering other markets, with the local focus we had was outside our reach.” After posting an investment opportunity, Silva received several connections to different international investors interested in technology.

Once connected, SMEs now present a much more attractive situation for investors. Through digital platforms, small and medium-sized businesses can now access and service the same international clientele as multinational companies. And they can do all of this without the overhead cost, public scrutiny, and shareholder instability that these large corporations incur.

“I would 200% recommend it! Opportunity Network allows us to globalize our company and go beyond our local market. – Fabia Silva, CEO of Dronak

The normalization of remote work also makes it possible for SMEs to hire diverse and talented teams. Furthermore, social awareness regarding the benefits of supporting SMEs nationally and internationally is growing. Altogether, these factors set the foundation for exponential growth in SME financing over the next 10 years.

What Will SME Financing Look Like in 2030?

Anything but small. Investors will be more likely to spread their capital between several companies. Likewise, SMEs will be engaging with a larger number of investors. This will result in a power shift as the dominant institutions of today cede market share to smaller players and digital conglomerates. The incumbent institutions who recognize this shift and adapt accordingly, partnering with collaborative FinTechs and investing in digital capabilities, will be the ones who continue to succeed.

Governments will also become increasingly part of the SME financing ecosystem. The World Bank estimates that 600 million jobs will be needed by 2030 in order to accommodate the growing global workforce. As SMEs are the largest providers of jobs, government stimulus for these companies will be given high priority. Changes in legal, and notably tax policies, will then be made to encourage growth in the space.